Mar 21, 2023

Hong Kong Overnight Funding Costs Double in Sign of Cash Squeeze

, Bloomberg News

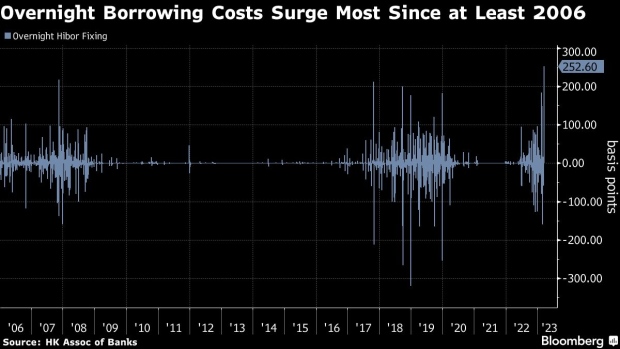

(Bloomberg) -- The cost to borrow overnight in Hong Kong jumped the most in at least 17 years, with market watchers pointing to stress in the global financial system as well as cash hoarding by banks ahead of the Federal Reserve rate decision and the quarter-end.

The overnight Hong Kong interbank offered rate, known as Hibor, surged 253 basis points to 4.14% on Tuesday. That’s biggest gain since data compiled by Bloomberg that began in 2006. The one-month gauge increased by 51 basis points, the most since 2008.

The cash squeeze came after the Hang Seng Index slumped on Monday, led by HSBC Holdings Plc, as investors weighed a collapse in the value of additional tier 1 bonds issued by lenders following the terms of the Credit Suisse Group AG’s rescue. The city’s financial markets stabilized on Tuesday, with the stock benchmark climbing 1.4%.

“Liquidity is obviously tightening, likely linked to the banking worries after the AT1 bond crisis drove premiums higher,” said Mingze Wu, a foreign exchange trader at StoneX Group in Singapore. “Hong Kong’s overnight borrowing cost surge is a reflection of this underlying stress in markets.”

Sixteen of the 20 contributing banks to Hibor had submissions of more than 4% on Tuesday, whereas the highest bid on Monday was 1.7%. HSBC Holdings Plc and Industrial & Commercial Bank of China Ltd.’s submissions were 2.8 percentage points higher than the previous day, the biggest increase among banks, according to data compiled by Bloomberg.

The city’s leader John Lee, speaking on Tuesday before the surge in borrowing costs, said Hong Kong’s banking system is resilient and liquidity in the market is “very abundant.” Exposure of the local banking sector and the market to Credit Suisse are insignificant, the Hong Kong Monetary Authority said in a statement Monday. A HKMA spokesperson wasn’t able to immediately comment on Tuesday’s increase in Hibor.

The gain in borrowing costs came on the eve of the Fed’s meeting. Hong Kong’s benchmark rate moves in lockstep with the Fed rate because of a currency peg to the US dollar.

Short-term interbank borrowing costs in Hong Kong have diverged from their US counterparts, with one-month Hibor trailing equivalent Libor by 1.25 percentage points, even after Tuesday’s increase. The gap has made shorting the Hong Kong dollar profitable, known as the carry trade.

Intervention by the HKMA to stop the currency from depreciating past the weak end of its currency band has mopped up cash in the banking system and helped make the carry trade less attractive, along with speculation the Fed will slow the pace of interest-rate hikes. The Hong Kong dollar touched its highest level against the greenback in a month on Tuesday.

The sharp shrinkage in Hong Kong’s interbank’s liquidity pool — measured by the aggregate balance — will increase volatility in Hibor, according to Gary Ng, senior economist at Natixis SA.

The HKMA’s aggregate balance has shrunk by more than 80% since its peak in 2021 to HK$77 billion, the lowest level in almost three years.

In addition to diminished interbank liquidity, market players including some Chinese institutions were less willing to offer Hong Kong dollar funding, resulting in the higher funding rate, a trader said. Other factors include quarter-end cash demand and unwinding of the carry trade, the trader said.

The Hibor rates are published daily and are based on calculations of quotes of 12 to 20 contributing banks selected by the Hong Kong Monetary Authority.

--With assistance from Nicholas Reynolds, Ruth Carson and Denise Wee.

©2023 Bloomberg L.P.