Nov 29, 2022

Hong Kong Peg Creator Says Sky-High Rates One Way to Defend It

, Bloomberg News

(Bloomberg) -- Hong Kong is willing to tolerate sky-high borrowing rates and near term economic pain to defend its currency peg with the dollar in the wake of renewed attacks by speculators.

“They would be willing to let Hong Kong dollar rates to rise to whatever level necessary to maintain the fixed exchange rates,” said John Greenwood, the architect behind the currency board mechanism created in 1983. “There’s a cost, but the dislocation caused by a fluctuating currency would have much bigger impact on domestic prices, import costs, and capital markets.”

Hedge fund titans Bill Ackman and Boaz Weinstein are shorting the currency to test and profit from that pain threshold. Ackman, the billionaire founder of Pershing Square Capital Management LP, said the peg no longer made sense for Hong Kong, referencing a Bloomberg Opinion column which argued that the social and economic toll of maintaining the link is too much to bear.

While financial conditions appear ripe for bears to emerge, those speculators underestimate the Hong Kong Monetary Authority’s willingness to preserve the peg, Greenwood said. That’s because the range-bound currency tied to the US dollar remains the city’s biggest draw for doing business with mainland China, a role it’s not looking to give up.

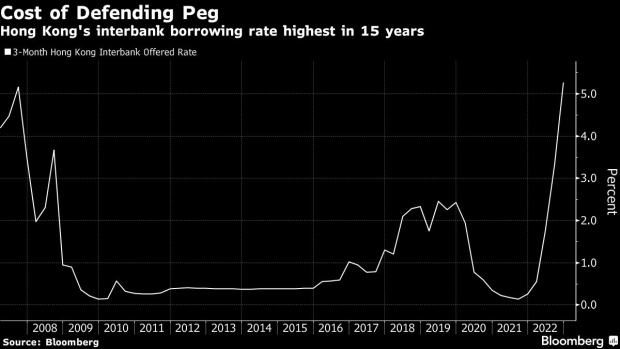

For the better part of this year, the Hong Kong dollar has traded at the weak end of the HK$7.75 to HK$7.85 band, which has prompted the de-facto central bank to step in to buy local dollars, sending borrowing costs higher. The three-month Hong Kong interbank offered rate now sits at 5.27%, the highest since 2007. The economy has also taken a hit after a prolonged Covid exit, with growth expected to decline more than expected this year into next.

Read: Ackman’s Big Hong Kong Short Comes at a Bad Time for Bears

Still, these signs of distress have yet to convince officials to change their official stance: Hong Kong doesn’t need nor intend to change its linked exchange rate system in response to Ackman’s comments, the HKMA said in a statement. The local currency traded at around 7.8112 per dollar on Tuesday.

“As long as Hong Kong authorities maintain high interest rates to attract flows, there will always be liquidity to counter those shorts,” Greenwood said. “They would allow domestic rates to rise as high as the sky rather than undermine four decades of currency stability.”

(Updates with prices in sixth paragraph)

©2022 Bloomberg L.P.