Nov 10, 2019

Hong Kong’s $530 Billion Stock Rally Is Showing Signs of Strain

, Bloomberg News

(Bloomberg) -- Hong Kong’s equity traders have made half a trillion dollars from a global risk rally. They’ll have little to fall back on when the exuberance fades.

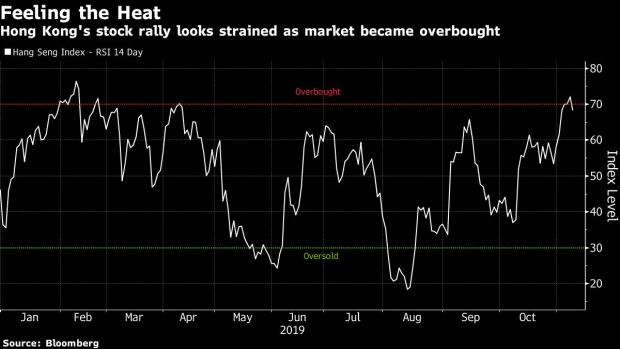

What worries pundits is that the rebound has been driven by a liquidity-fueled global risk rally, and that Hong Kong’s bleak economic situation has yet to fully filter through to stocks. The Hang Seng Index is up 9% from an August low, back above the key 27,000-point level, and it briefly rose above its 200-day moving average last week. But it is also near levels that signal it is overbought.

Faced with its worst business outlook since the 2008 financial crisis and a plunge into recession, a chill may be coming for Hong Kong’s corporate earnings. It may soon be time to sell, said He Qi, a fund manager with Huatai Pinebridge Fund Management Co. who called the rally in mid-August.

“Hong Kong’s gains are just part of a global risk-on rally amid a flood of liquidity, and the short-term gains are way too strong,” said He, adding that China’s elevated inflation leaves authorities with little room to further cut interest rates, putting such a liquid environment at risk. “I might consider lightening positions as the index approaches 28,000 points, and even more so if it rises toward 30,000.” The index closed 0.7% lower Friday at 27,651.

China’s largest brokerage Citic Securities Co. earlier this month trimmed its earnings growth forecast on the Hang Seng gauge to 4% this year from a previous estimate of as much as 8%. The continuing protests in the city and the impact on commercial property, retail and tourism industries has gone beyond expectations, strategists led by Yang Lingxiu wrote in a note dated Nov. 4.

To be sure, traders can still find opportunities in a market where many firms rely on the mainland for earnings. China’s A shares are about 27% more expensive than their Hong Kong listed peers, compared with a long-term average of 20%. “There are so many bargains left on the table,” said Sean Darby, a global strategist at Jefferies Hong Kong.

Still, the recession will likely make its presence felt in earnings for this year and in the first quarter of 2020, said Ken Chen, a Shanghai-based strategist with KGI Securities Co.

“There’s no end in sight to the local unrest and expectations of an economic recovery next year remain low,” he said. “Hong Kong is just rising along with global markets, and the gains will pause when the global rally weakens.”

--With assistance from Cindy Wang.

To contact Bloomberg News staff for this story: Amanda Wang in Shanghai at twang234@bloomberg.net

To contact the editors responsible for this story: Sofia Horta e Costa at shortaecosta@bloomberg.net, David Watkins, Philip Glamann

©2019 Bloomberg L.P.