Nov 29, 2021

Hong Kong Stocks Slide to 13-Month Low on Fresh Virus Woes

, Bloomberg News

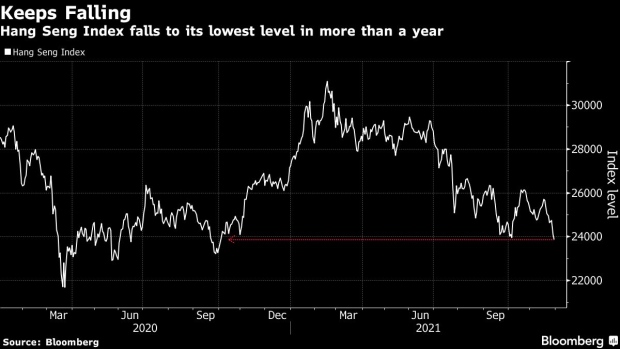

(Bloomberg) -- Hong Kong’s stock benchmark closed at the lowest level in more than a year on Monday, as the omicron Covid-19 strain fueled worries about the outlook of border reopening and economic growth.

The Hang Seng Index fell 0.9% to its lowest level since October 2020, extending a 2.7% drop on Friday. Meituan led the declines after reporting widening net loss for the September quarter. It was followed by Macau casino operators Galaxy Entertainment Group Ltd. and Sands China Ltd. after police arrested the city’s junket king.

“The Hang Seng Index is expected to face downward pressure in the near term as there’s a lack of positive catalysts,” said Kenny Ng, a strategist at Everbright Sun Hung Kai Co. “The omicron variant may hamper old economy stocks like financials, casinos and consumer, while new economy shares are not completely out of the regulatory storm yet.”

A slew of disappointing earnings by big Chinese technology firms and faster-than-expected tapering by the U.S. Federal Reserve have been weighing on market sentiment for Hong Kong-listed equities. The Hang Seng Index has dropped nearly 9% from a recent peak in October. It is down more than 12% so far this year, becoming one of the worst-performing global stock benchmarks over the period.

©2021 Bloomberg L.P.