May 12, 2021

Hot Inflation Reading Heightens Fed Guessing Game: Traders React

, Bloomberg News

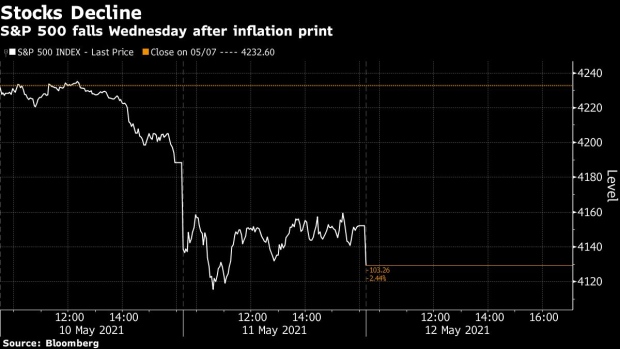

(Bloomberg) -- The biggest year-over-year increase in consumer prices in more than a decade rattled financial markets, with highly valued tech stocks tumbling and Treasury yields spiking higher.

The reading contrasts with the sharp price plunge in April last year when the pandemic sent much of the economy into lockdown. The Federal Reserve has long warned that it won’t rush to react to what it says will be uneven data. But with prices rising across industries and supply bottlenecks mounting, traders have grown concerned that inflation is here to stay.

Here’s what market participants are saying:

Seema Shah, chief strategist at Principal Global Investors:

“What have we really learned today that we didn’t already know? Markets were already expecting a rise in inflation -- the big question is how sticky that inflation is. That has not been answered today, nor will it be answered for several months. Nonetheless, risk markets will continue to be whipsawed by inflationary concerns over the coming months and investors would be wise to introduce some inflation protection into their portfolios.”

Sam Stovall, chief investment strategist at CFRA Research:

“Powell does need to come out and give a confidence boost to remind investors that ‘No, we still think this is transitory and we don’t think this is going to be the beginning of a new sharply higher trend,’” Stovall said. “Maybe the Fed also says that this is going to be the high point and all subsequent readings will be on the leeward side of this CPI mountain.”

Mike Loewengart, managing director of investment strategy at E*Trade Financial:

“The markets have been hovering around all-time highs with a lot of the reopening trade already priced in. So it’s not out of the question that the outsized inflation read could bring us back down to earth a bit. Keep in mind the Fed has made it clear that it won’t let inflation increases necessarily sway it from its easy-money policies, and further any jumps like this could be transitory. So is this a trend? That remains to be seen.”

Michael Mullaney, director of global markets research at Boston Partners:

“The question remains as to if it is transitory or not, the base effect, i.e. the rebound due solely to last year’s deflation is about 70% of the number printed today. If it is not transitory, then that high of a print breaches the 3.5% limit to where P/E multiples get hit (contract). It will be good for value and bad for growth, especially if it feeds into a higher interest-rate structure.”

Willem Sels, chief investment officer of private banking and wealth management at HSBC:

“Once we have seen the peak in the base effects, Treasuries should stabilize, and this should be a positive for equities, investment-grade and high-yield corporate bonds and emerging market assets. The peak of inflation should also coincide with the bottom for technology stocks.”

Fiona Cincotta, senior financial markets analyst at StoneX’s City Index:

“The fact that the U.S. dollar surged and tech looks set to take a hit suggests the market is pricing in a sooner move by the Fed to tighten policy. There is still another inflation print due before the Fed trade decision in June, and another jobs report. However, given surging inflation and commodity prices, the Fed may have to reconsider how transitory it believes inflation will be.”

Adam Crisafulli, the founder of Vital Knowledge, wrote in a note:

“The number, despite being VERY hot, really shouldn’t change anyone’s view of the world. Base effects and a few one-offs (like used autos) are accounting for a lot of the inflation firming. Meanwhile, investors are already expecting price increases to occur now –- the debate is whether they are still galivanting higher in Q4 once the denominator begins to firm. This CPI will make Biden’s life that much more challenging on the fiscal front (a big Build Back Better bill is increasingly unlikely) and will cause more Fed officials to at least acknowledge the potential for a Nov/Dec tapering.”

©2021 Bloomberg L.P.