May 5, 2023

Hot Jobs Report Raises Odds Fed Keeps Rates Higher for Longer

, Bloomberg News

(Bloomberg) -- The unexpected pickups in US hiring and wages last month increase chances the Federal Reserve will hold interest rates high for longer and potentially keep the door open to an 11th straight hike in June.

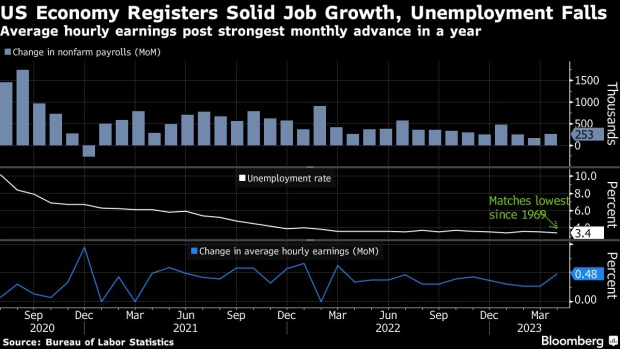

Nonfarm payrolls rose 253,000 last month, a Bureau of Labor Statistics report showed Friday. Economists had expected an increase of 185,000. The unemployment rate fell back to a multi-decade low of 3.4%.

Fed Chair Jerome Powell, speaking in a press conference Wednesday after officials wrapped up their May 2-3 meeting, said the labor market remains “extremely” tight and is one of the data points he and his colleagues will be carefully assessing as they determine whether more hikes are needed to cool the economy.

“The labor market remains tight, and the economy is still creating jobs at a rapid pace,” said Rubeela Farooqi, chief US economist at High Frequency Economics. “There is a risk that the Fed will raise rates further based on these data and sticky inflation readings.”

The Fed has lifted borrowing costs aggressively over the past 14 months, bringing their benchmark federal funds rate to a range of 5% to 5.25%, but has indicated it may pause and hold them high from now. Powell said that easing inflation and tighter credit conditions following a string of bank collapses may give the Fed room to assess the impact of their policy on the economy.

While Friday’s report reinforces the notion that a key part of the economy remains resilient and may be able to withstand further tightening, policymakers will see another labor-market reading and several inflation reports before their June 13-14 meeting.

St. Louis Fed President James Bullard said policymakers will probably have to push rates higher to cool inflation, but said he would wait and see what the data show before deciding what move to support in June.

“The aggressive policy we pursued in the last 15 months has stemmed the rise in inflation, but it is not so clear we are on” a path to 2%, Bullard told reporters Friday following an event in Minneapolis Friday.

Financial-market estimates, which see a rate cut as early as September, continue to be out of line with forecasts from the Fed, where none of the 18 policymakers see a reduction this year.

“It reduces the odds of cuts and reinforces higher for longer,” Neil Dutta, head of economics at Renaissance Macro Research LLC, said of the jobs report.

Investor concern that the economy is headed for a recession in the second half of the year has bolstered bets for a cut in interest rates soon. But most policymakers remain focused on bringing down inflation, which by some key metrics has stalled out at levels far above the Fed’s 2% goal.

Friday’s jobs report showed that average hourly earnings rose 0.5% in April, the most in about a year on an unrounded basis, and a 4.4% increase from a year ago. That mirrors a rise in a key gauge of wages and benefits released last week that showed employment costs rose in the first quarter for the first time in a year.

“Wage growth was strong, indicating continued inflationary pressures from the labor market,” Gus Faucher, chief economist with PNC Financial Services Group, wrote in a note to clients.

Revisions in payroll gains for February and March, which reduced previous estimates by 149,000 jobs, added to signs that parts of the workforce are starting to show signs of a slowdown, and could reassure Fed officials that their effors to cool the economy are working.

“We think it would take a lot more than this report – a sustained large upside surprise across the remaining labor reports and the inflation reports – along with renewed moderation of bank stress to get the Fed to jump quickly to the conclusion that it is not yet sufficiently restrictive,” Evercore ISI’s Krishna Guha wrote in a note to clients.

(Updates with economist comment in fourth paragraph.)

©2023 Bloomberg L.P.