Mike Cagney’s Figure Technology Taps Tannenbaum as Its New CEO

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

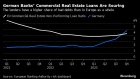

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Aug 16, 2021

, Bloomberg News

Canada’s housing market posted its fourth month of sales declines as the number of people looking to sell their homes saw a precipitous decline despite prices near record levels.

Transactions fell 3.5 per cent in July, with new listings dropping 8.8 per cent, according to data released Monday from the Canadian Real Estate Association. That caused the national average home price to rise 0.3 per cent to around $669,200 (US$532,600), while the ratio of sales to new listings, a measure of market tightness, rose to 74 per cent from 70 per cent the previous month.

Since the pandemic caused a buying frenzy in Canada that sent sales and prices to record heights in March, the market has been steadily cooling off as prospective buyers contend with a dearth of new houses for sale. Though increasing vaccination rates have begun to bring a return to normal life in Canada, that’s left the country to contend with one of the developed world’s most severe housing shortages and little prospect of much new supply becoming available soon.

“We are not returning to normal, we are only returning to where we were before COVID, which was a far cry from normal,” Shaun Cathcart, the national real estate board’s senior economist, said in a press release accompanying the data. “The problem of high housing demand amid low supply has not gone anywhere -- it’s arguably worse.”

The decline in listings was seen across Canada’s major cities, including Toronto, Montreal and Vancouver, with new supply down in about three quarters of the country’s markets, the data show. But despite this tightening, and the resulting drop in activity from the previous month, July home sales were still well above the average from the last 10 years.