May 5, 2017

Housing, oil, Trump: What's behind the slumping loonie?

, BNN Bloomberg

The Canadian dollar dipped to its lowest levels in 14 months this week leaving analysts looking for explanations on how the loonie got here and what could be next.

Concerns about U.S. protectionism, the hot housing and sinking crude prices have all been cited as a factor for the currency slump that sent the dollar to lows not seen since its recovery from 2016’s record 12-day losing streak.

So what’s the cause of all of this? Well, it depends on who you ask.

The hot housing sectors in Toronto and Vancouver have drawn the attention of all levels of government, but Scotiabank’s chief currency strategist doesn’t see a reprise of the Great Recession ahead.

“That’s been a bit of an underlying theme, I think, for many investors outside of Canada for the past few years, this idea of ‘The Great White Short’ trade,” Shaun Osborne told BNN on Tuesday.

“We were going to see a replication of the stresses we saw in the U.S. housing sector and the financial sector and clearly, that hasn’t happened. It’s a much, much differently-structured market here and [that’s] unlikely to occur, I think, in the way we saw in the U.S.”

He thinks a depressed loonie is a good thing for Canadian exports.

"If we get to around 70, 71 cents, the Canadian dollar is going to start to look a bit cheap, I think."

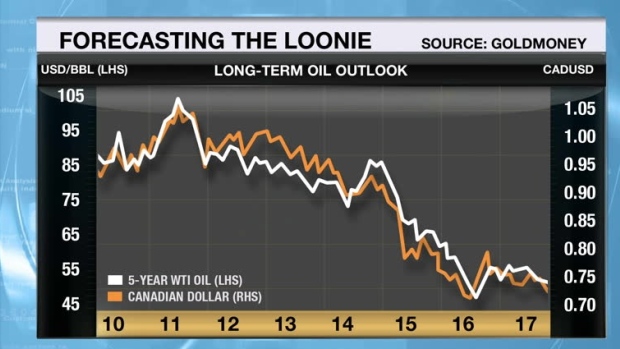

The five-month lows crude reached this week did little to aid the commodity-linked currency. However, one analyst thinks that drop has left the loonie right about where it should be, with the dollar having already withstood its biggest hit.

“The Canadian dollar probably bottomed last year when the market was really trying to figure out ‘what is that marginal cost of crude really at?’ Josh Crumb, chief strategy officer and chief financial officer at Goldmoney Inc. told BNN on Friday.

“In the first quarter of last year, sure, the spot price tanked, but so did the long-dated price and we saw what happened to drilling and shale. I think the market has kind of had that price discovery and I think actually the Canadian dollar is kind of where it should be.”

The fear of U.S. protectionism is also lingering as Canadians continue to fret over how the Trump administration will alter the make-up of North American trade.

However, BMO’s global head of FX strategy sees the loonie being well positioned against the U.S. dollar in the short-term.

“I think the (U.S.) dollar has topped out,” Gregory Anderson told BNN on Thursday. “Unless [the Trump administration] is able to pass some type of meaningful tax reform - it almost doesn’t matter what it looks like. if they pass something, I’ll revise my call and move the U.S. dollar 10 per cent higher. Barring that, I think it’s topped out and it’s heading south from here.

“I would be a buyer of (the) Canadian dollar here,” Anderson added. “In the FX market, what we’ve seen continually is, wait til people get really built up into a position and seek pain… and the pain is CAD (going) higher.”

One thing that Canadians may not need to worry about, however, is the specter of an interest rate hike from the Bank of Canada, at least as far as CIBC’s deputy chief economist is concerned.

“Yes, the dollar’s been going down recently for different reasons but that’s not enough for [Poloz] to actually even hint about raising interest rates,” Benjamin Tal told BNN on Wednesday.

In a poll conducted by BNN, a majority cited lower oil prices as their chief concern about the current state of the Canadian dollar. Of the 1,572 votes cast, 42 per cent of respondents picked oil prices, while an additional 34 per cent picked the Trump administration. An additional 24 per cent chose the outlook for interest rates.

The loonie hit its weekly low at 1:31 a.m. on Friday, trading at 72.50 U.S. cents. It was trading at 73.22 U.S. cents as of Friday's market closing time.