Mike Cagney’s Figure Technology Taps Tannenbaum as Its New CEO

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

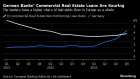

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Apr 19, 2023

, BNN Bloomberg

As home prices have declined across Canada on a year-over-year basis, a new analysis from Ratehub.ca found that homes are less affordable amid higher interest rates.

In a release Monday, Ratehub.ca said that affordability deteriorated in nine out of 10 cities in Canada, with buyers needing an income increase between $5,650-$21,360 in order to purchase a home.

“While home prices are down significantly in the majority of the cities we looked at, the income required to purchase a home still remains inflated due to higher mortgage and stress test rates,” James Laird, the co-chief executive officer of Ratehub.ca and president of CanWise Mortgage Lender, said in the release.

The release said conditions around affordability are likely to get worse given current market trends.

“With supply of new listings tight and some homebuyers returning to the market, don’t expect home affordability to improve in the coming months,” said Laird.

Findings were derived from calculating the minimum annual income needed to purchase a home across major real estate markets in Canada, using figures between March 2022 and March 2023, the release said. Ratehub.ca said its findings highlight impacts on affordability from interest rates, real estate prices and the stress test.

The average price of a home in Canada in March was $686,371, marking a 13.7 per cent decline from the previous year, according to the Canadian Real Estate Association (CREA).

“Even though home values are down in nine out of 10 cities we looked at, affordability has actually gotten worse because rates have increased so much that Canadians now qualify for less compared to a year ago,” said Laird.

Vancouver saw the sharpest annual increase in income required to purchase a home, coming in at $21,360, the release said.

The Toronto housing market was ranked eighth regarding declines in affordability, according to the release. Despite an average year-over-year price decline of $216,500 in the nation's largest housing market, buyers need an additional $6,250 to purchase a home compared to March 2022.

“Hamilton was the only city to see home affordability improve year-over-year with $4,460 less income required due to a drop in average home price of $224,200, the largest decline of all the cities,” said Laird.

METHODOLOGY

Ratehub.ca said data for the analysis was derived assuming a mortgage with a 20 per cent down payment, 25-year amortization, annual property taxes of $4,000 and a $150 monthly heating bill.

Mortgage rates were based on an average of five-year fixed rates in March 2023 and March 2022 from Canada’s big five banks, Ratehub.ca said.

Average home prices were taken from CREA’s Home Price Index.

Change in income needed to purchase a house: