Nov 20, 2018

How Policy Changes Kept America's Silver Workforce On The Job

, Bloomberg News

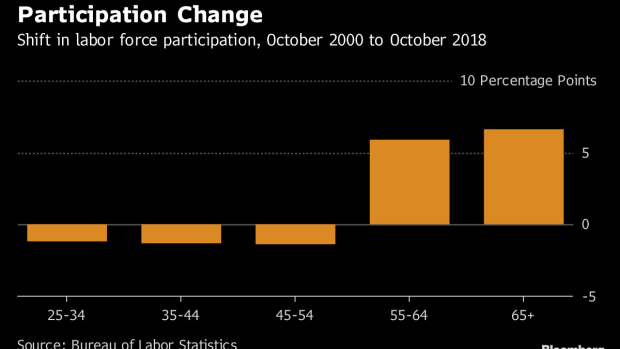

(Bloomberg) -- The share of people working or looking for work is well below 2000 levels for prime-age Americans. But move up the age range and the story changes.

Workers older than 55, and especially those over 65, have become more and more likely to work in recent years, bucking the trend seen among their younger counterparts. That may owe partly to public policy, as Wellesley College’s Courtney Coile points out in a new National Bureau of Economic Research working paper.

(You’re reading Bloomberg’s weekly economic research roundup.)

Changes to the Social Security program have made it easier for older Americans to work without incurring financial penalties. First, 1983 amendments to the Social Security Act created an incentive for working later in life by increasing payouts for people who delayed retirement and by lifting the official retirement age. Then came the Senior Citizens’ Freedom to Work Act of 2000, which changed the Social Security earnings test, eliminating it for those who retired late.

All together, changes to Social Security reduced the implicit tax on work between the ages of 65 and 69 by about 15 percentage points, Coile writes.

Those shifts didn’t happen in a vacuum: just as policy was becoming more permissive of late-in-life work, employers were switching from defined-benefit pension plans to defined-contribution plans. What’s more, work became less physically demanding, allowing employees to stay on the job longer.

Given those structural drivers, older Americans should continue working in greater numbers -- and while that’s partly a symptom of economic insecurity, in other ways it’s a good-news story. It gives employers a larger pool of available and experienced people. What’s more, a recent paper from the Center for Retirement Research at Boston College has shown that working longer may increase longevity, especially for men.

Other Research Worth a Read…

Border WallsNational Bureau of Economic Research

Expansion of border walls between Mexico and the U.S. from 2007 to 2010 cost taxpayers about $7 per person, while boosting per-capita income for low-skill workers by a “paltry” 36 cents, researchers from Dartmouth College and Stanford University estimate in this working paper.

America’s two economies remain far apartBrookings Institution

Democrats won districts that encompass 60.9 percent of America’s economic activity in the midterm elections while Republican districts accounted for 37.6 percent of output, based on a Brookings Institution analysis. “Democratic districts are more productive, with a strong orientation to the advanced industries that inordinately determine prosperity,” Mark Muro and Jacob Whiton write. Republican districts are oriented to lower-output industries and non-advanced manufacturing.

The Seven Deadly Paradoxes of Cryptocurrency Bank of England blog

“Existing private cryptocurrencies do not seriously threaten traditional monies because they are afflicted by multiple internal contradictions,” writes John Lewis of the U.K. central bank. Among the issues he raises: they’re hard to scale, expensive to store and tough to liquidate. They’re also anonymous, which raises the risk of market manipulation and fraud.

Financial Structure and Income Inequality Bank for International Settlements

Financial development -- or improving a nation’s financial system by deepening markets and boosting access and efficiency -- reduces income inequality, but only up to a point. That’s the insight from this paper that looks at 97 economies from 1989 to 2012 and finds that while gaps close during the early stages of financial development, they widen later on if financial development occurs via the market (rather than via bank lending).

To contact the reporter on this story: Jeanna Smialek in New York at jsmialek1@bloomberg.net

To contact the editors responsible for this story: Brendan Murray at brmurray@bloomberg.net, Scott Lanman

©2018 Bloomberg L.P.