Sep 21, 2021

How portfolio managers pick international stocks for your portfolios

Presented by:

If you’ve dabbled in owning individual stocks, you know what a challenge it is keeping tabs on even the couple thousand issues in a small market like Canada’s. Now imagine creating a global portfolio, which is something most investors must do to diversify. You’ll have to expand your horizon around the world to capture literally tens of thousands of public equities in the investable universe. Where do you even start?

It’s a question Mackenzie’s fund managers face every day. The process starts with the philosophy of the fund – how it aims to create value for its clients. Each of its fund managers have their own investing philosophy, but Bryan Mattei, a Hong Kong-based vice-president and portfolio manager with Mackenzie’s Asia Team, takes a fundamental, bottom-up stock picking approach. “We construct portfolios in a way that ensures stock selection is the dominant performance driver,” he says. “Our strength is finding attractive businesses at attractive prices.”

That means that Mattei, who manages the Asia-Pacific component of the Mackenzie Global Small-Mid Cap Fund, focuses on the attributes of the companies themselves rather than macroeconomic or sectoral strategies. He narrows down the list of companies he’ll consider to those based in 13 Asia-Pacific countries with a market capitalization between US$500 million and US$14 billion. The fund has a “GARP approach,” he says, meaning he looks for stocks showing growth at a reasonable price.

Searching out diamonds in the rough, however, is not a one-person job. Mattei and his office head, senior vice-president and portfolio manager Nick Scott, work with two traders and five analysts who are focused on different countries and sectors. Asian small and mid-cap markets are volatile, Mattei points out, and to have trading and research capabilities on the ground allows the team to take advantage of this.

Picking winners

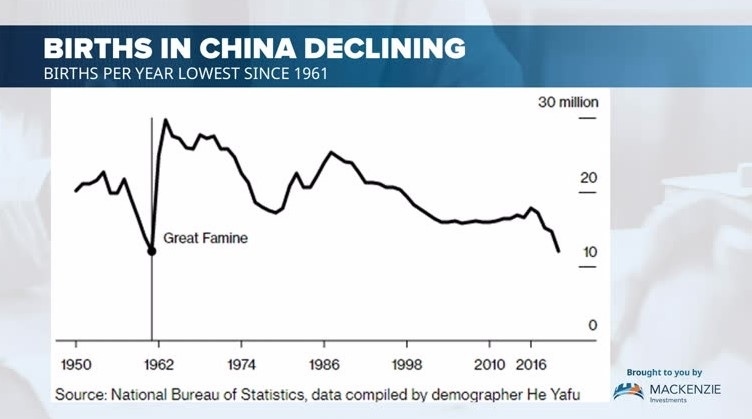

The process of singling out individual stocks to own begins with a series of quantitative screens, using metrics such as return on invested capital and earnings consistency over time. Mattei also identifies stocks to watch based on themes the team thinks will create opportunities for resilient future growth. Those themes include addressing the rapidly aging demographics of North Asia, solving the kinks in global supply chains caused by COVID-19 and making up for Asia’s past under-investment in public health and life sciences.

Once those themes are identified, the real work begins. The team conducts qualitative research, visiting (when international travel is permitted) and interviewing hundreds of companies a year. And they’re not just asking about the latest quarterly results – if inflation is a factor in the company’s industry, they’ll ask if they possess the pricing power to pass this on to customers, or mitigate internally. They also pose questions such as, what does management see as the most impactful opportunity over the next five years? Can the company account for fair labour practices along the entire supply chain?

Research involves talking to customers and industry experts, too. “Having a strong product offering or valuable intellectual property is important, but so is the team behind it. Our research process is dedicated to deeply understanding both,” Mattei says. In other words, a company must not only be positioned for earnings growth but have the management team needed to execute its plan.

The whole exercise helps establish a watchlist of companies of interest. If and when a stock on the list dips down to a valuation Mattei considers attractive, it can earn a place in the portfolio. When that stock gets ahead of itself, he’ll take his profits.

The active advantage

“We’re very focused on valuation. We’d rather own a good company at a great price than a great company at the wrong price,” Mattei says. He favours firms that dominate a global niche, such as Tsubaki Nakashima Co., a Japanese manufacturer commanding more than half the world market for the steel and ceramic ball components that go into ball bearings, or Shimadzu Corp., a maker of mass spectrometry and liquid chromatography instruments key to producing pharmaceuticals and ensuring purity in food and drinking water.

His fund also holds national champions that have shown an ability to grow outside their home market like City Chic Collective, an Australian online retailer of plus-sized women’s apparel that gained serious market share when public health orders shut down its bricks-and-mortar competitors. “It’s very capital efficient growth,” Mattei says. “The management have gotten it right. They’re meeting the demand of a very specific consumer that feels underserved, with a long runway for growth ahead of them, and a scalable business model that can match the opportunity.”

Even the most knowledgeable do-it-yourself investors and advisors could never do this kind of on-the-ground research on their own and would be better served owning an actively managed global fund. In the Asia small and mid-cap space, where retail investors represent a large share of equity market activity, and sell-side research is relatively sparse, investors are ill-served by passive index funds. These markets tend to be inefficient, with more mispriced stocks and opportunities for savvy stock-pickers. That’s why an actively managed global portfolio, where professionals do the hard work of isolating the best opportunities, can be most beneficial.

“Active management adds value,” Mattei says. "The large number of under-researched companies in this region creates the opportunity to do that.”

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This article may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of September 2, 2021. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.