Apr 1, 2022

How to keep those pandemic-era savings habits if you’re going back to the office

, BNN Bloomberg

Creating an emergency savings fund amid ongoing uncertainty

Personal finance experts are warning many Canadians’ pocketbooks could be in store for a major adjustment as they head back into the office.

“For many Canadians, their expenses during the COVID-19 pandemic completely changed,” said Barry Choi, personal finance expert and founder of MoneyWeHave.com, in an interview.

“People who have been working at home or on a part-time basis during the pandemic are going to go through an adjustment period over the next few months.”

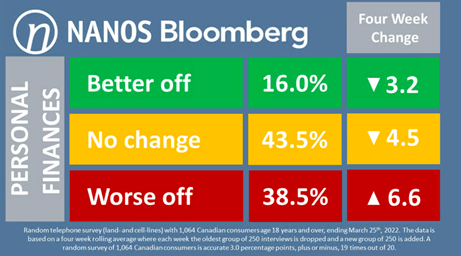

The latest weekly read on the Bloomberg Nanos Canadian Confidence Index, which surveys 250 Canadians on a variety of topics, showed more residents were growing concerned about their financial situation. The poll found about four-out-of-10 respondents said they’re financially worse off now than they were four weeks ago.

“At the height of the pandemic, more Canadians were likely to say their finances improved, with a number of people benefiting from government support and a massive disruption to normal consuming habits,” said Nik Nanos, chief data scientist and founder of Nanos Research, in an interview.

“People are in a different psychological place now compared to the height of the pandemic when Canadians were in lock down. But during that time, they were also able to lock down more savings than usual.”

As people start to head back into the office, Choi said it’s important to be aware of different expenses that might arise.

“Some people are used to a gas budget right now of around $100 a month, but that could be doubled or tripled depending on the individual and how often they will be driving to work,” Choi said.

He also warned individuals may have forgotten about how much money they spend while socializing with colleagues at the office.

“They might go out for coffee with another employee, shop at nearby stores or eat at restaurants for lunch. All of these costs that went away for two years are coming back,” he said.

When it comes to setting yourself up for financial success before heading back into the office, most experts point to the importance of having a budget or updating your current one.

“As you’re contemplating what life is going to be like, you should be prioritizing where that money is going to go,” said Tim Cestnick, co-founder and chief executive officer of Our Family Office Inc, by phone.

Cestnick said Canadians should start by either personally tracking their expenses or using an online tool like Mint.com to understand what they’re spending on.

After getting a better picture of your finances, Cestnick suggested structuring a budget to first prioritize putting money into savings, then your cost of living, paying down debt, miscellaneous expenses and finally, entertainment.

But just because workers are heading back into the office, that doesn’t mean Canadians need to leave behind the good saving habits they picked up during COVID.

Naveen Senthamilselvan, senior manager for wealth at Meridian, suggested if you’ve been saving on takeout while working from home, for example, you should continue to proactively meal prep when you head back into the office.

Another area Choi said Canadians should revisit are all the additional at-home luxury costs that might have accumulated during the pandemic such as an upgraded internet plan or additional streaming platforms. He said those extra expenses might not be as justifiable if you’re spending much less time at home.

Finally, if you’re having a hard time sticking to your budget, it might be time to ask for a pay increase.

“It’s not easy asking for a raise but the great resignation is taking place right now. Employers are having a tough time finding good workers and keeping their best people,” Cestnick said.

“If you haven’t received a pay increase in a while, you should think about asking for one since that could help with these additional costs as you transition back into the workplace.”