Feb 8, 2023

How to Solve High Battery Prices and Other Electric-Car Quandaries

, Bloomberg News

(Bloomberg) --

BloombergNEF just convened its annual San Francisco summit focused on the challenges and opportunities for the transport, energy and technology industries.

BNEF’s analysts raised some of the biggest questions facing these sectors and offered some answers. Three of my favorite presentations covered the cost of batteries, the market forces driving electric vehicle adoption and the role of new technologies in decarbonizing transport:

Can high prices in the battery industry cure high prices?

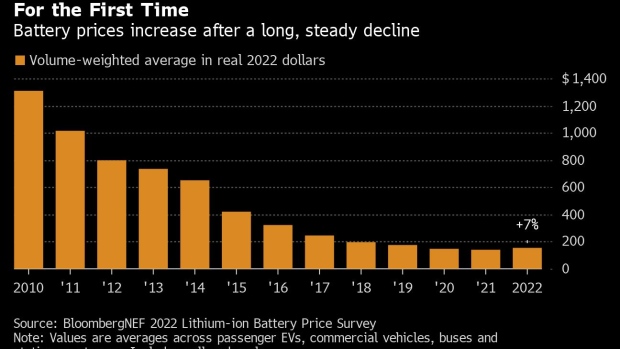

The battery supply chain groaned under the weight of rapid expansion and economic turbulence last year: We saw the first increase in pack prices since BNEF began tracking them in 2010.

While prices are likely to remain elevated in 2023, this has the potential to push the industry forward in productive ways. Higher prices mean more manufacturing capacity will be brought online quicker. Lower-cost chemistries will be pursued with more urgency, and automakers and battery manufacturers will aggressively streamline their raw material supply strategies.

BNEF battery analyst Evelina Stoikou explains all this in greater depth in her presentation: Rising Battery Prices: The End of an Era?

With EVs accounting for more than 26% of passenger vehicle sales in China, is the hard work over in the quest for EV adoption?

China kickstarted its EV market with a combination of subsidies and tax credits. After consumers purchased around 6 million EVs in 2022, the government phased out purchase-tax exemptions and other incentives, letting market forces to take over.

Uptake of EVs is highest in China’s minicar segment, followed by large cars at the other end of the vehicle spectrum. The removal of upfront incentives will test the sustainability of EV penetration in those segments and pose a challenge to China’s massive middle market. With around 1.8 million public charging connectors deployed in China, there’s infrastructure in place to support further adoption.

Policymakers in other parts of the world will closely watch how this plays out, as they’re eager to learn from China exactly how and when they can begin to tighten the incentive tap.

BNEF electric vehicle analyst Siyi Mi dissects this in her presentation: China’s EV Market After the Inflection Point

Do driverless cars have a role to play in decarbonizing the transport sector?

As someone who was able to test out a driverless Cruise robotaxi in San Francisco over the past week, I find it difficult not to talk about the technology with excitement.

However, now that robotaxis are real, there are a host of problems big and small still left to solve beyond improving the core technology, from optimizing pickup and drop-off locations, to ensuring passengers don’t leave belongings in vehicles.

In the long term, fleets of carefully deployed robotaxis could be valuable assets in the mission to decarbonize transportation. These vehicles are more likely to be electric than their privately driven counterparts and provide more efficient passenger miles than humans driving personally owned vehicles. When accounting for the vital roles that increased use of public transit, micromobility and other alternatives to private car ownership will play in passenger vehicle demand, BNEF estimates that uptake of shared and autonomous mobility could mean 220 million fewer cars end up on the road by 2040.

BNEF intelligent mobility analyst Jinghong Lyu lays out the case for self-driving vehicles in her presentation: Are Driverless Cars About to Clean Up?

©2023 Bloomberg L.P.