Mar 19, 2019

How to Trade Around a Fed Meeting Full of Potential Wild Cards

, Bloomberg News

(Bloomberg) -- The Federal Reserve’s policy decision Wednesday is being eagerly anticipated by investors looking for further details about what the pivot to patience on rates means, how the new “dot plot” will look and how policy makers will approach inflation-targeting and balance-sheet runoff.

While there’s a lot of uncertainty surrounding these issues, markets are optimistic as shown by a rally in stocks and cross-asset volatility near historic lows. There’s a feeling in markets that policy clarity is improving not just at the Fed, but also at central banks in Europe, Japan and China.

Having said that, there are a number of possible wild cards that may be come out of the Fed decision, due 2 p.m. Wednesday in Washington. Here are some thoughts from analysts and strategists on how to navigate markets through the Fed announcement.

UBS AG (Stuart Kaiser et al.) - New York

The euro has larger average and absolute moves -- 0.9 percent and +/- 1.2 percent, respectively -- than assets like the S&P 500 or 10-year Treasury yields when dots are lowered, strategists led by Kaiser wrote in a note Monday. The yen has also responded to lower dots, but to a lesser extent, they said.

“FX moves suggest a global risk-on dynamic, so low FX implied volatility offers attractive optionality for the FOMC,” UBS said.

Most of the impact on stocks from the Fed meeting will come before the announcement, they said. The S&P 500 has moved +/- 0.6 percent on days of Federal Open Market Committee statements since 2012.

However, on the five occasions dots were lowered, the gauge rallied an average 1.8 percent in the week before the meeting, “suggesting the moves were well-telegraphed,” the strategists wrote. S&P 500 returns were negative on average in the following week, he said.

Goldman Sachs (Zach Pandl, Ian Wright) - New York/London

Goldman is looking for confirmation that the FOMC’s move away from trying to tighten financial conditions will last for some time, which is one of the key points in the company’s medium-term bearish U.S. dollar view, strategists led by Pandl wrote March 15.

“Focus on a potential shift by the Fed to an average inflation target remains, and is likely contributing to U.S. break-even inflation and real rates moving in opposite directions recently,” strategists led by Ian Wright wrote March 18.

During four periods since 1980 when the Fed held rates relatively high for an extended time, “at face value we find equities tended to do relatively well, although toward the end or the beginning of each period performance appears more mixed,” Wright said, adding that the tech bubble influences some of the observations.

BMO Capital Markets (Jon Hill, Ian Lyngen) - New York

The Fed decision has a strong possibility of being a “buy the news, sell the fact” event given extremely dovish expectations, Hill and Lyngen wrote in a March 18 note.

They’re watching the 2s/10s curve, “particularly if the set-up for Wednesday corresponded to price movements probing multi-week lows,” they said. “This would indicate that momentum going into the decision is clearly leaning toward a flattening bias, at least in this benchmark curve, and open the door for a quick steepening back toward 20 basis points were the median 2019 dot to imply zero additional hikes.”

“The Fed’s aim is certain to be a continuing of the peaceful low-vol regime,” the strategists wrote. “Although the FOMC represents a potential risk event,” they said, “any resulting vol spike would likely be interpreted as a Powell-produced policy error.”

JPMorgan Chase & Co. (Marko Kolanovic et al.) - New York

Commodity sectors of the stock market are likely to benefit from the Fed’s greater tolerance of an inflation overshoot, JPMorgan Chase & Co. strategists led by Kolanovic wrote in a March 14 note. Those include European miners, beneficiaries of rising oil prices and stocks that are helped by rising inflation.

They raised their rating of commodities to a 2 percent overweight from a 0 percent active weight in the note, a monthly report on global asset allocation.

“Our commodity overweight also serves as an inflation hedge, given the Fed’s expected strategic shift,” they said.

Evercore ISI (Krishna Guha) - Washington

While the Fed’s plan to conclude its balance-sheet reduction is likely to come in the second half of the year, “when the reinvestment plan comes, it will skew towards bills and other shorter-dated Treasuries, favoring a slightly steeper yield curve,” according to Guha. Any comments from Powell in the press conference on reinvestment should be consistent with that, he said.

AMP Capital Investors Ltd. (Nader Naeimi) - Sydney

Nader Naeimi, a portfolio manager at AMP Capital Investors, is going long the dollar versus a basket of currencies including the yen, Thai baht and South African rand, into the Fed meeting.

“The Fed won’t be hawkish -- so rates will be on hold -- but the Fed will be more hawkish than what’s priced into the markets,” Naeimi said. “Markets will be surprised when the Fed decides to go ahead with what’s planned instead of calling an end” to the balance-sheet roll-off.

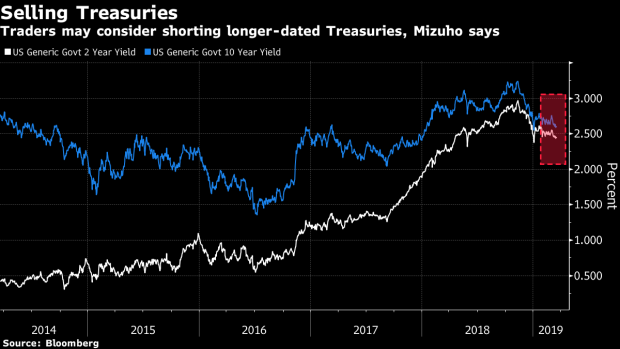

Mizuho Bank Ltd. (Vishnu Varathan) - Singapore

“A pure short on the long end may be also on the cards, if one believes that ‘patient’ has been too stretched as of now, and so long-end yields may have to go a little higher (or at least adjust off the lows),” according to Vishnu Varathan, head of economics and strategy at Mizuho Bank in Singapore.

Pendal Group (Vimal Gor) - Sydney

Gor is long duration at the front end of the Treasury curve, and has yield-curve steepeners in place, he said in an interview Tuesday.

“The market will take virtually all of their utterances as dovish,” he said of the FOMC.

--With assistance from Ruth Carson and Andreea Papuc.

To contact the reporter on this story: Joanna Ossinger in Singapore at jossinger@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Nicholas Reynolds, Todd White

©2019 Bloomberg L.P.