Jun 9, 2023

HSBC Among UK Banks Pulling Mortgage Deals From the Market Again

, Bloomberg News

(Bloomberg) -- UK lenders, led by HSBC Holdings Plc, are temporarily removing mortgage deals as they prepare to reprice home loans to account for inflation.

HSBC said on Thursday that it was removing new business residential and buy-to-let products that it offers via broker services. It said the offerings will be back Monday at increased rates.

The bank on Friday afternoon reopened its broker channel for several hours after working to increase capacity.

“We remain open to new mortgage business, however to help ensure that new customers get the best possible service we occasionally need to limit the amount of new business we can take each day via broker services,” a spokesperson for the bank said in a statement. “All products and rates for existing customers are still available, and we continue to review the situation regularly.”

The number of home loan products available in the UK was 5,056 on Friday, according to data company Moneyfacts Group Plc. That’s about 4% lower than at the start of May, but the highest daily amount this month, suggesting some lenders may be putting deals back on the market at higher rates.

It’s the latest blow to cash-strapped homeowners, who are already grappling with higher borrowing costs and a possible drop in house prices. Households are cutting down other expenses to cover higher loan repayments, while many prospective buyers are avoiding the mortgage market altogether.

“Each time it becomes clear that the Bank of England will soon hike rates, the cheapest lender on the high street gets overwhelmed,” said Hina Bhudia, partner at Knight Frank Finance. “Much is going to depend on the next CPI reading due later this month.”

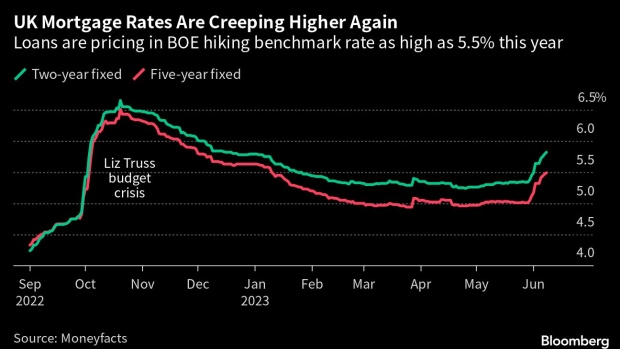

The average two-year fixed-rate mortgage on a home rose to 5.83% on Friday, the highest since December, after a high inflation reading last month prompted money markets to bet that the BOE will keep raising rates through this summer. Meanwhile, the average five-year fixed-rate deal remained just below 5.5%.

Andrew Montlake, managing director at mortgage broker Coreco, said it was inevitable mortgage costs would rise after inflation numbers pushed up swap rates. “I’m praying the worst is over,” he said.

Ray Boulger, a manager at loan broker John Charcol, said the mortgage deals at higher rates would impact property prices.

What Bloomberg Intelligence Says:

“The hit of confidence is likely to weigh on house prices in the second half of the year, as the pool of buyers shrinks, while an increasing group of homeowners — even if we believe it to be relatively limited compared to past crises — may decide to sell their home amid surging mortgage repayments.”

— Iwona Hovenko, Equity Research Analyst

The average two-year fixed-rate mortgage across the nation’s six biggest lenders — which includes HSBC, Lloyds Banking Group Plc, and Nationwide Building Society — has surged above 5% again since the start of June, according to price comparison website Uswitch. That’s a concern for tens of thousands of UK households that are on two-year fixed-rate mortgages which are due to expire in September.

Though the UK inflation rate fell back into single digits in April, it continues to outpace wage growth. Potential buyers are finding it even harder to afford the cost of repaying a home loan, contributing to net mortgage lending falling to virtually zero in March, according to BOE data.

At least one more mortgage lender is likely to pull its rates on Friday, John Charcol’s Boulger said.

“It was obvious mortgage rates were going to have to go up, I’m just surprised it’s taken so long,” Boulger said. “It’s going to knock people’s confidence and they won’t be able to get as big a loan.”

(Updates with details on HSBC in third and fourth paragraph.)

©2023 Bloomberg L.P.