Feb 28, 2022

HSBC, BlackRock Shed Light on Hidden Role of Financed Emissions

, Bloomberg News

(Bloomberg) -- The world has just been handed its first set of hard data exposing the extent to which major financial firms are contributing to climate change, and how crucial their actions are in the race to slow it.

HSBC Holdings Plc and Barclays Plc revealed last week that they’re each responsible for financed emissions equivalent to roughly 18% of the total carbon footprint of the U.K. That followed a landmark set of climate disclosures from BlackRock Inc., which indicate the asset manager’s emissions at least rival those of Volkswagen AG, Europe’s biggest car manufacturer.

The mere fact that these financial giants have started making their carbon footprint public marks a milestone moment in the battle against global warming. The calculation is widely acknowledged to be fiendishly difficult, as banks and fund managers must get a handle not only on the direct emissions from the companies they give capital too, but also the emissions that results from their supply chains and customers.

Yet until all financial firms follow suit, an essential plank in efforts to keep the average temperature rise within the critical threshold of 1.5 degrees is missing. According to a report released Monday by the world’s top climate scientists, the breakneck speed of global warming is exceeding the pace of efforts to protect billions of vulnerable people.

“We know quite well the carbon footprints of almost all economic sectors today, but we don’t have that data for financial services, so having big institutions like HSBC and BlackRock report financed emissions is huge,” said Laurent Babikian, joint global director of capital markets at CDP, a nonprofit that tracks climate impact.

“If we want to reach net zero, we need to know what the carbon footprint of the financial sector is so we can say how much it needs to decarbonize by, and by when,” he said.

HSBC Chief Executive Officer Noel Quinn said such disclosures are a necessary next step after the bank last year pledged to reach net-zero emissions by mid-century. The bank has also been under considerable pressure from climate activists and shareholders to document its progress.

HSBC, Barclays and BlackRock are among roughly 450 financial firms across the globe representing $130 trillion in assets that have committed to net-climate neutrality by 2050. So far, only a handful have released meaningful emissions data. Quinn said HSBC is planning “increased, robust disclosures.”

The Numbers...

HSBC’s data show that emissions produced from its loans to oil and gas totaled 35.8 million tons of CO2 equivalent, a measure that includes CO2 and methane pollution, in 2019. A further 29.5 million tons of the greenhouse gases resulted from capital market activities, such as arranging bond deals.

A spokesperson for the bank says it opted for 2019 data in part to offer a clearer picture of emissions without the distortions that came with the pandemic. Companies representing approximately 90% of HSBC’s financed emissions will be asked to provide transition plans by the end of this year, the spokesperson said.

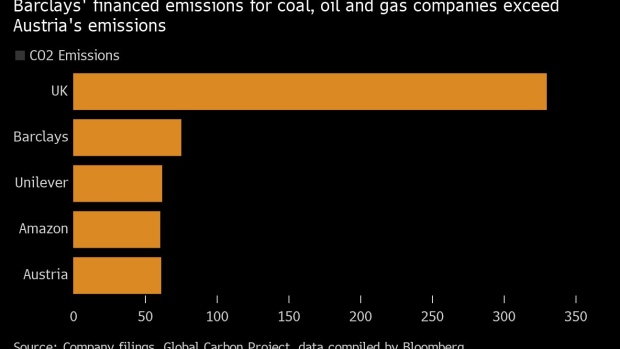

Barclays says it faciliated 58.6 million tons of CO2 emissions last year for oil, gas and coal clients last year. The bank, which has developed its own methodology for measuring financed emissions and tracking them against the goals of the Paris Agreement, said it reduced its footprint by 22% from 75 million tons in 2020.

For context, 60 million tons of CO2 is equivalent to almost a 10th of Exxon Mobil Corp’s total emissions, according to data compiled by Bloomberg based on company filings.

BlackRock was responsible for 330.7 million tons CO2 equivalent of absolute emissions in 2020 for corporate securities and real estate holdings representing over 65% of its total assets. The world’s largest asset manager said it lacked the data to calculate the emissions of all its holdings. Volkswagen reported around 370 million tons of CO2 emissions in 2020.

Since the Paris climate agreement was struck in late 2015, global banks have funneled about $4 trillion into the fossil-fuel industry, according to data compiled by Bloomberg. And though the industry has recently started matching its oil and gas funding with an equivalent level of support for green projects, climate activists warn it’s still too little too late.

“Finance is the lifeblood of the economy, so banks play a critical role in enabling -- or restraining -- emissions in the real economy,” said Jeanne Martin, senior campaign manager at U.K. nonprofit ShareAction.

“Universal banks like Barclays and HSBC are exposed to many companies that are ideally positioned to accelerate the low-carbon transition, but also many that are blocking progress,” she said.

So far, estimates of the finance industry’s contribution to global warming have mostly only covered direct emissions, or so-called Scope 1 and 2 emissions, thus capturing just 20% of the greenhouse-gas footprint for which the sector is responsible, Babikian said.

The Partnership for Carbon Accounting Financials, which aims to establish an industry standard for assessing and disclosing the greenhouse gas emissions associated with banks’ loans and investments, said more than 200 firms representing more than $60 trillion have now signed up. That suggests there’ll soon be a wave of emissions reporting from the wider industry.

“It’s very valuable to have these disclosures,” said Rick Lacaille, global head of environmental, social and governance initiatives at State Street Corp. “But the important thing, from a net zero perspective, is what happens next.”

©2022 Bloomberg L.P.