(Bloomberg Opinion) -- HSBC Holdings Plc will need more than a nip and a tuck if it’s to ease Chairman Mark Tucker’s envy of his JPMorgan Chase & Co. counterpart Jamie Dimon.

Tucker told managers recently that more than 30% of HSBC’s capital was generating returns of less than 1% and singled out the American bank as a template to emulate. At roughly $2.75 trillion in total assets, the rivals are similar in size. Yet under Chairman and CEO Dimon, JPMorgan ekes out 1.3% on assets while Europe’s largest lender routinely struggles to garner even half as much.

The latest period was no different, as HSBC’s third-quarter results painfully demonstrated. Adjusted third-quarter pretax profit, which excludes one-time items, fell a worse-than-expected 12% to $5.3 billion. HSBC abandoned a target for return on tangible equity of more than 11% in 2020, even as it credited operations in Asia for withstanding challenges in the region.

Part of the slump is cyclical. Net interest margins so far in 2019 have averaged 1.59%, eight basis points lower than the same time last year. A weaker global economy and falling interest rates have reversed the good times for Hong Kong and Singapore banks.

Still, HSBC has some unique problems. Chief among them is that it has too much capital deployed in Europe, where the bank’s cost-to-income ratio is more than 100%. Only a quarter of HSBC's loans are in the U.K., but the country is a source of as much as 35% of its nonperforming loans, according to Daniel Tabbush, a bank analyst who writes for the research website Smartkarma.

Shrinking in Europe, where returns significantly lag behind Asia, will allow for a much-awaited pivot to Asian markets outside of Hong Kong and China. With its corporate network, the London-based bank competes well in financing trade links between the region and the rest of the world. HSBC is the region’s top lender to companies, ahead of Citigroup Inc. and Standard Chartered Plc, according to Gaurav Arora, head of Asia for Greenwich Associates. It’s also the top bank in Asia for trade finance and cash management.

Those strengths haven’t translated to heft in investment banking. It may be just as well. Margins in that business have been under relentless pressure since the global financial crisis, while the rise of passive investing has crimped equity-trading fees. Income from corporate banking is a lot stickier, provided Tucker and acting Chief Executive Officer Noel Quinn can expand the franchise beyond Hong Kong, which accounts for almost 60% of pretax profit.

With property prices holding up amid anti-government protests and sporadic violence, the lucrative Hong Kong mortgage business is still providing the bulk of HSBC's overall lending growth. Wealth management revenue and insurance sales in the city are both starting to look weak, though. Loan quality is also starting to slip. While Brexit-related uncertainty in the U.K. didn't lead to any changes in loan-loss allowances in the third quarter, Hong Kong’s deteriorating economic outlook resulted in a $90 million charge.

Excessive reliance on the China market may backfire, too. HSBC was left out of a key rate-setting mechanism in August even as StanChart and Citi were included. The bank was reportedly punished for offering up evidence that led to the arrest of the CFO of national champion Huawei Technologies Co. in Canada. HSBC stock dropped 2% in Hong Kong after the results, bringing its decline this year to 6.9%. The benchmark Hang Seng Index has gained more than 4%.

Efficiency remains the key to addressing Tucker’s JPMorgan envy. HSBC’s cost-to-income ratio of 61% compares with the New York-based bank’s 56%. The British bank still has plenty of flab to attack, particularly in its European and investment-banking operations.

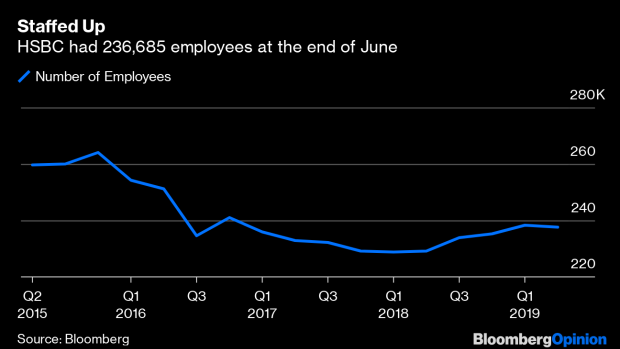

With Quinn promising to “rebalance our capital away from low-return businesses,” investors will expect deep cuts in coming months. If the interim CEO is serious about making his role permanent after replacing John Flint, who lasted just 18 months in the job, he’ll have to act fast.

Cosmetic surgery won’t please anybody.

To contact the authors of this story: Nisha Gopalan at ngopalan3@bloomberg.netAndy Mukherjee at amukherjee@bloomberg.net

To contact the editor responsible for this story: Matthew Brooker at mbrooker1@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Nisha Gopalan is a Bloomberg Opinion columnist covering deals and banking. She previously worked for the Wall Street Journal and Dow Jones as an editor and a reporter.

Andy Mukherjee is a Bloomberg Opinion columnist covering industrial companies and financial services. He previously was a columnist for Reuters Breakingviews. He has also worked for the Straits Times, ET NOW and Bloomberg News.

©2019 Bloomberg L.P.