May 27, 2019

Huawei Supplier Surges in Hong Kong After Canceling NYSE Listing

, Bloomberg News

(Bloomberg) -- A major Chinese chipmaker surged in Hong Kong amid prospects that its decision to stop trading in New York will attract more volume to its main listing.

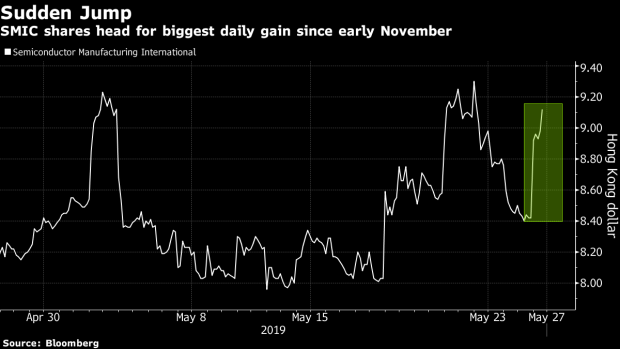

Shanghai-based SMIC, whose biggest customer is the parent of Huawei Technologies Co., the high-profile subject of a U.S. ban, led gains on the MSCI China Index with a 9.3% rally Monday morning. It was a different story for its ADSs, which tumbled 5.6% on Friday in New York after the firm said its board approved delisting due to considerations including limited trading volume and costs.

“The rise in the shares today is mainly due to expectations that U.S. trades in the stock will be funneled over to the Hong Kong-listed company, meaning more demand for the Hong Kong-listed stock,” Csc International Holdings Ltd. analyst Zhu Jixiang said. The decision could also be linked to the escalation in Sino-U.S. trade tension, he said.

“SMIC is one of the top foundries, and right now semiconductors are a sensitive area,” Zhu said. “The company executives might be retreating to save themselves potential worries in the future -- after all, being listed in the U.S. means they are subject to securities regulation and frequent executive travel to the U.S.”

SMIC didn’t respond to calls for comment, but state-owned news outlet Cankaoxiaoxi quoted a spokesperson as saying the company had long been considering a delisting and that the decision wasn’t connected to the trade dispute or U.S. ban on Huawei. “Delisting takes a lot of time to prepare, and it is a coincidence it’s happening now,” the person was quoted as saying.

Data compiled by Bloomberg show that SMIC gets about 18% of its revenue from Huawei, whose billionaire founder told Bloomberg Television that the company will ramp up its own chip supply or find alternatives because of U.S. sanctions.

In a note published Sunday, China International Capital Corp. said the Huawei ban might prompt Beijing to lend more support to the domestic semiconductor industry and that trade friction is a good opportunity for homegrown products to replace imports. SMIC was in line for its biggest daily gain since Nov. 2, while Hua Hong Semiconductor Ltd. also rallied, climbing as much as 6.2%.

To contact Bloomberg News staff for this story: Jeanny Yu in Hong Kong at jyu107@bloomberg.net;April Ma in Beijing at ama112@bloomberg.net

To contact the editors responsible for this story: Sofia Horta e Costa at shortaecosta@bloomberg.net, Will Davies

©2019 Bloomberg L.P.