Jun 22, 2021

Hungary Hikes Base Rate to End Years of Ultra-Loose Policy

, Bloomberg News

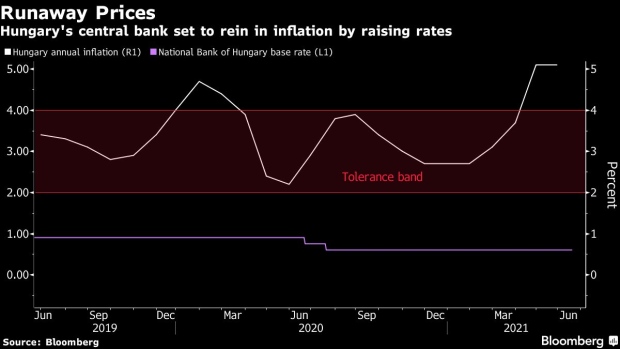

(Bloomberg) -- Hungary raised its benchmark rate for the first time in a decade to curb the European Union’s fastest inflation, the biggest monetary tightening step the trading bloc has seen since the coronavirus outbreak. The forint dropped.

Policy makers led by Governor Gyorgy Matolcsy hiked the benchmark rate to 0.9% from 0.6%, as expected, on Tuesday. The decision followed weeks of speculation over the size and pace of the central bank’s actions to come, with a market split leading to swings in the forint. The forint was down 0.5% against the euro after the decision.

As the world’s biggest central banks weigh whether a spike in global inflation is more than transitory, some of their counterparts in the EU’s eastern wing aren’t taking any chances. The Czech Republic may follow Hungary in raising borrowing costs as soon as Wednesday as inflation presses against the top of the central bank’s tolerance band.

“The NBH promised ‘effective’ tightening and delivered, which is very important,” said Marek Drimal, EMEA Strategist for Societe Generale SA in London. “It’s a start of new era for monetary policy in Hungary and for the forint.”

In Budapest, attention now shifts to a statement at 3 p.m. where investors will look for clarity about whether the base-rate hike marked the start of a monetary-tightening cycle, as many strategists expect, and if so, whether monthly or quarterly steps will follow. Matolcsy will also lead a briefing that may shed more light on future plans.

In a sign of the stakes, and potentially to underline a commitment to break with years of ultra-loose monetary policy, Matolcsy said Monday that Hungary is at risk of speculative attacks without action. He said an election-year 2022 budget that’s poised to fan inflation combined with negative real interest rates were a potentially combustible mix.

Investors struggled to make sense of the tightening plans. While Deputy Governor Barnabas Virag had spoken of a “decisive” tightening move, rate-setter Gyula Pleschinger said hikes should take into account the fragility of the economy and would likely happen once a quarter.

Even after economists doubled their rate-hike forecast, they trail the expectations of money-market traders, who are betting the three-month Budapest interbank rate -- a widely-used gauge for the prevailing interest rate in the economy -- to rise by more than 50 basis points by September to close to 1.5%.

The cloudy outlook has whipsawed the forint, which has gone from the second-best performing emerging-market currency in May -- when it rose 3.7% against the euro -- to the worst, with a 2.2% drop so far in June.

Another lingering question is the future of the one-week deposit facility, whose interest rate is set on Thursdays. Economists expect the rate on the facility -- which had become the effective benchmark since the central bank raised it above the base rate in September -- to be aligned with the base rate.

The central bank may also phase out some stimulus programs but is expected to keep its government bond purchases in place.

(Updates with forint in first and second paragraphs, strategist quote in fourth.)

©2021 Bloomberg L.P.