Nov 9, 2022

Hungary Moves to Shield Budget From Mounting Central Bank Losses

, Bloomberg News

(Bloomberg) -- Hungary’s government seeks to change rules that would force it to quickly recapitalize the country’s central bank as it accumulates huge losses.

Draft legislation on the government’s website extends the period during which the government must compensate -- in cash -- for National Bank of Hungary losses to five years from the current period of eight days. If implemented, the law will spread out over time and potentially reduce billions of dollars in government obligations.

While the world’s major central banks are in the red following aggressive tightening aimed at cooling a once-in-a-generation inflation spike, the relative scale of the Hungarian monetary authority’s rate hikes, and its losses, are bigger. The developments come at a tough time for Hungary, which is struggling to rein in its budget deficit and remains locked in a rule-of-law conflict with the European Union, freezing access to some funds.

“The proposed change will make it easier to plan the budgetary effect of the central bank operation,” the Finance Ministry said about the legislation, in an emailed response to questions from Bloomberg News.

The draft bill says that any shortfall on the central bank’s balance sheet “shall be borne by the central budget equal annual installments over a period of five years.” The government would have no obligation to compensate losses if retained earnings swing to positive in the period.

The central bank turned a profit of 798 billion forint ($1.98 billion) between 2013 and 2020, according to its annual reports. From this, it paid 600 billion forint to the government in dividend, while stashing most of the rest as either retained profit or giving it to a sprawling network of foundations, which invested in real estate and other assets.

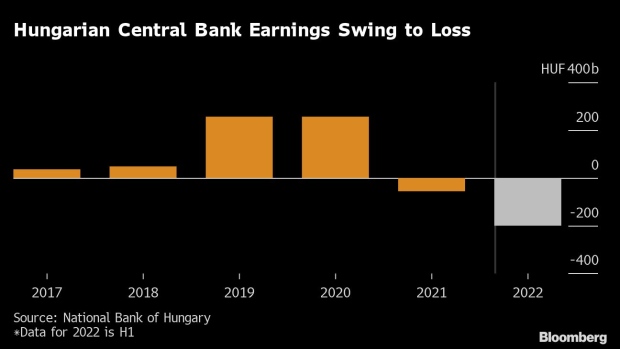

The central bank incurred losses of 201 billion forint during the first half of this year and 57 billion forint during all of 2021, leaving it with retained earnings of 151 billion forint at the end of June.

Full year losses will probably “more than double” the sum from the first half, while 2023 losses will be higher, according to Sandor Jobbagy, a senior analyst at Concorde Securities in Budapest.

The bank’s losses are fueled by a shortfall in net interest income, which is set to grow as effective interest rates stood at 7.75% in June, and have since been raised to 18% -- boosting the costs of liquidity-draining operations. On the other hand, its balance sheet is weighed down by low-yielding assets -- both domestic and foreign -- accumulated mainly during the bygone era of monetary expansion.

“The central bank’s losses mean that there is less room to support the economy, even as both external and internal conditions are trending toward recession,” Jobbagy said.

©2022 Bloomberg L.P.