Oct 19, 2021

Hungary Sticks With Smaller Rate Increase Despite Forint Wobble

, Bloomberg News

(Bloomberg) --

Hungary’s central bank shrugged off pressure to intensify its fight against surging inflation after surprisingly tapping the brakes on its drive to raise borrowing costs.

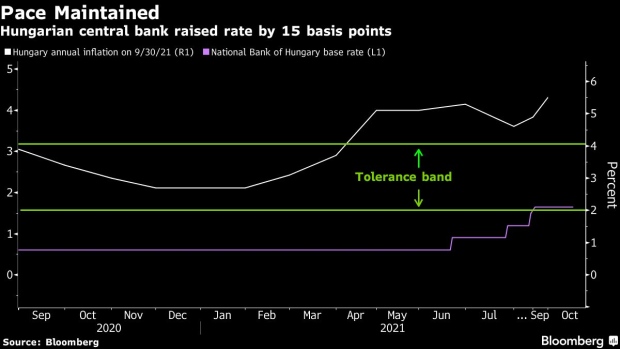

Policy makers raised the benchmark interest rate by 15 basis points on Tuesday to 1.80%, matching the median estimate in a Bloomberg survey. The move is the same as in September, when the central bank defied market expectations by not continuing with another of the 30 basis-point monthly increase delivered from June to August.

While Hungary initially led the European Union with the most aggressive monetary tightening during the summer, central bankers have since slowed their campaign, citing the threat to economic recovery from a new wave of coronavirus cases. Poland and the Czech Republic have responded to spiking price growth with larger rate increases this month, while Romania joined in with a quarter-point hike as inflation hit the highest in a decade.

The forint has erased all gains since the start of the tightening cycle in June and has dropped 2% against the euro since the last rate meeting in September. It touched the weakest level in six months on Monday before paring losses before the rate decision. The yield on the 10-year government bond has jumped 74 basis points to 3.89% in the last month.

Meanwhile, cost pressures are rising. Price-growth, which is already the fastest since 2012, is forecast to spiral further in part due to pre-election plans for a $2 billion family tax rebate and a 20% increase in the minimum wage.

The central bank’s monetary tightening is “far from the end,” Deputy Governor Barnabas Virag told reporters on Oct. 1 in remarks aimed at reassuring investor concerns. Virag is scheduled to speak at a around 3 p.m. in Budapest at a conference, coinciding with the publication of a central bank statement about the rate decision.

While policy makers aren’t considering increasing borrowing costs faster, the central bank is ready to slow liquidity injections via the swap market and to continue tapering its quantitative easing program, Virag said on Oct. 1.

That’s not fazing investors. They now expect the three-month Budapest interbank rate -- which is already 24 basis points above the benchmark rate -- to rise by a further 72 basis points this year, according to forward-rate agreements.

©2021 Bloomberg L.P.