Oct 22, 2019

Hungary to Hold Policy in Wait for CPI Trend: Decision Day Guide

, Bloomberg News

(Bloomberg) -- Hungary’s central bank will probably stay put after a modest easing step last month, as a slowing world economy tempers the impact of a tight labor market.

The Monetary Council is set to keep its overnight-deposit interest rate and the base rate at -0.05% and 0.9% respectively, according to a Bloomberg survey. With rate setters in a self-defined “data-driven” mode, the next review of policy is unlikely before December, when the central bank is set to publish updated forecasts.

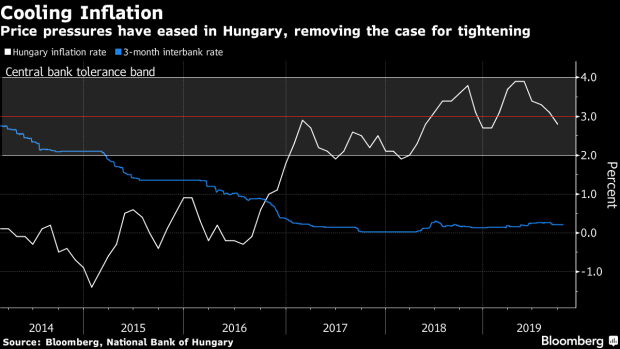

Consumer-price growth has slowed below the 3% target and the forint has appreciated from a record low, removing the urgency to tighten one of the loosest monetary arrangements in Europe. Hungary’s inflation rate is “adequate,” Deputy Governor Marton Nagy told a conference last week.

“Barring a huge negative shock (either external or internal), the National Bank of Hungary is likely to remain on the sidelines both in October and November,” said Mariann Trippon, an analyst at Intesa Sanpaolo’s CIB unit in Budapest. “Neither the recent macroeconomic releases nor market developments justify any monetary policy adjustments.”

The central bank will announce its rate decision at 2 p.m. in Budapest, followed by a statement an hour later.

The 3-month Bubor rate, the main measure of financing conditions in the economy, has held at 0.21% since Sept. 12, with forward-rate agreements indicating 15 basis points in increases in the next 12 months. The forint rose to 330 per euro on Monday, the strongest in six weeks.

--With assistance from Harumi Ichikura.

To contact the reporter on this story: Marton Eder in Budapest at meder4@bloomberg.net

To contact the editors responsible for this story: Dana El Baltaji at delbaltaji@bloomberg.net, Michael Winfrey, Andras Gergely

©2019 Bloomberg L.P.