Jun 5, 2023

IATA Latest: Profit May Hit $10 Billion, Twin Aisle Jet Crunch

, Bloomberg News

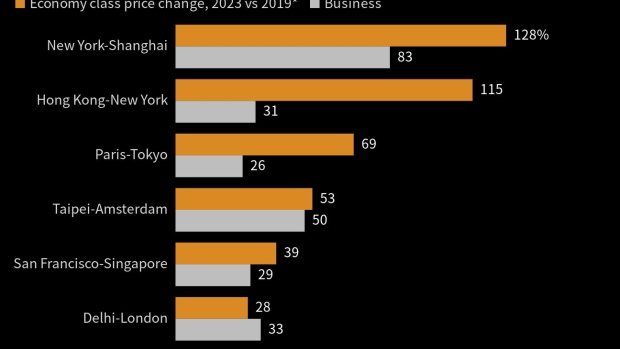

(Bloomberg) -- The airline industry’s main lobby body is doubling its estimate for global net profit in 2023 as a surge in flying drives up ticket prices, although risks include rising interest rates to combat spiraling inflation and lingering supply chain issues.

Airline executives from the some 300 airlines represented by the International Air Transport Association descended on Istanbul over the weekend for the start of the trade organization’s 79th annual general meeting. More than 1,520 participants are taking part in the event, the first being held since all Covid restrictions were lifted.

On the agenda are topics including sustainability, as carriers navigate the path toward achieving net zero carbon emissions by 2050, as well as airlines’ recovery from Covid, lessons learned from 2022’s host of operational challenges and how to achieve gender equality.

High air fares and labor shortages from pilots to ground handling staff are also expected to be hotly debated. Next year’s IATA AGM will be held in Dubai, in June.

Key Developments

- Airlines Bask in Sky-High Summer Fares While Airports Stay Stuck

- Airline Executives Herald Revival They Predict Is Here to Stay

- IATA Global Airline Profit Estimate Jumps to $10 Billion in 2023

- Qatar Airways Plans for Future Without First Class on Long-Haul

- Summer Travel in Paris Seen as Dry Run for 2024 Olympic Games

(All times Istanbul)

Skynest Pods Should ‘Work a Treat’ (6:32 p.m.)

Air New Zealand Ltd. CEO Greg Foran said he expects the airline’s new bunk beds on its ultra-long Auckland-New York and Auckland-Chicago routes, which economy-class passengers can rent in four-hour blocks for about $100 an hour, will “work a treat.”

Read more: Sleep Pod Rentals for $100 an Hour Planned on Air NZ Flights

“But most importantly, we’re providing a service for customers who are on a long flight, usually overnight and you’re sitting down the back of the plane,” Foran said. “So you’ve got an option here to buy an economy seat, you can take four hours to lie flat during the night, without having to spend the extra that you would for either premium economy or business class. Let’s see how it goes. We’re excited about it.”

Turkish Air Mega Order (5:30 p.m.)

Turkish Airlines is about two months away from a final decision on ordering as many as 600 jets, including 400 narrowbody planes and about 200 widebody aircraft, Chairman Ahmet Bolat said on Monday in Istanbul.

Turkey’s national carrier is on the cusp of potentially one of aviation’s single-largest plane orders, a magnitude that’s become more frequent with the number of sizable, ambitious transactions touted or locked-in of late as airlines rush to secure jets amid a shortage.

“This is a big decision, the government will have the final say, until then we’ll finish all the technical details” like the delivery stream and pre-delivery payments, Bolat said.

Russian Airspace a Risk (3:50 p.m.)

United Airlines Holdings Inc. Chief Executive Officer Scott Kirby said flying over Russia constitutes a risk that many carriers including his own won’t take, while airlines from China or India enjoy a competitive advantage as they continue to traverse the airspace.

“I think it creates a safety and security risk,” Kirby said, highlighting concerns for the safety of US citizens on such flights, or the possibility of being forced to land in Russia for a variety of reasons.

India’s the New China (2:30 p.m.)

India is the new China as international travel rebounds, Qantas Airways Ltd. Chief Executive Officer Alan Joyce told Bloomberg TV’s Guy Johnson.

The Chinese market remains “very weak” at about half the level it was before Covid. “We think India has better growth prospects than China for us and we are putting more capacity in.”

Business is booming there and in other markets, Joyce said, adding his voice to other airline executives in Istanbul discussing air travel’s leisure-driven comeback. Demand is double pre-Covid levels in the Australian carrier’s domestic market and 80% higher for international flights, he said. “We have nowhere near that capacity to meet that demand.”

Planemakers Voice Optimism (2:16 p.m.)

Airbus SE Chief Commercial Officer Christian Scherer voiced cautious optimism that the supplier snags and production issues that have slowed an increase in narrowbody jet output may be starting to subside. “You never know where the issue is going to come from,” he told Bloomberg TV’s Guy Johnson. “There seems to be — and I say this very carefully, Guy — a tendency towards stabilization.” Scherer added that there are still some areas of the supply chain, including engines, “that are holding us back.”

His comments follow a similarly careful assessment by rival Boeing Co. of its 737 Max production ramp up. Speaking at last week’s Bernstein Strategic Decisions event, CEO Dave Calhoun, pointed out that the US planemaker has always expected a bumpy road. “Our belief is, and our experience, more importantly, is that these bumps are getting lower, smaller,” Calhoun said. “The resolution of them is getting faster.”

JAL Weighs Aircraft Needs (1:38 p.m.)

Japan Airlines Co. is evaluating its long-term requirements for new aircraft over the next 10 years for regional and long-haul flights, senior executive Ross Leggett said. “We’re currently looking at the best mix for us,” said Leggett, senior vice president of route marketing. “It’s an open book.”

The airline is weighing up its aircraft needs, months after securing an order for 21 737 Max jets. Older jets to be replaced include the Boeing 767 and current generation 737s.

Every Weekend’s a Holiday (12:25 p.m.)

The advent of hybrid work has made “every weekend a holiday” and gives people more time to travel, United Airlines Holdings Inc. CEO Scott Kirby said. After two years of Covid lockdowns “people will no longer take for granted their ability to travel and experience,” Kirby said, when asked about whether elevated levels of demand for travel are sustainable.

Kirby was less upbeat about business travel, saying the “US economy is in a business recession.” “We see that in our business traffic, but you can also see that in the kinds of companies that sell to business,” he said.

Malaysia Seeks More Narrowbodies (11:30 a.m.)

Malaysia Airlines Bhd. is seeking to add at least 25 single-aisle aircraft and will look to discuss options with both Airbus and Boeing, Chief Executive Officer Izham Ismail said.

“The number is definitely 25 or more,” Izham said. The carrier will only know the exact number of required aircraft after Izham meets the airline’s board in August, he said.

Airbus Hits Back (11:18 a.m.)

“Some observers believe it or not, right here at the IATA AGM, are actually making the point that the supply constraint versus significantly higher demand might be not so bad, because it’s helping airlines to increase yields,” Airbus’s Scherer said when asked earlier about production delays.

“We don’t play that game. We are not throttling back or putting a lid on our ability to deliver the airplanes that have been ordered,” he said, describing the delays as a “matter of constraint deep down in the supply chain, not a voluntary action of retaining.”

Most customers understand the supply-chain constraints still facing the industry, he says. “We will deliver the airplanes that have been ordered.”

Blocked Funds Threaten Connectivity (11:05 a.m.)

Rising levels of blocked funds are a threat to airline connectivity, with unavailable finances increasing by 47% to $2.27 billion as of April from $1.55 billion in April last year.

Nigeria is the worst offender, at $812.2 million, followed by Bangladesh at $241.1 million. Algeria, Pakistan and Lebanon round out the worst five.

IATA urged governments to abide by international agreements and treaty obligations to enable airlines to repatriate the funds, which typically arise from the sale of tickets, cargo space and other activities.

Virgin Has Room for Growth (10:28 a.m.)

Virgin Atlantic Airways Ltd., which expects record revenue this year, has options for more Airbus SE widebody jets. “There’s always room for growth,” Chief Executive Officer Shai Weiss says in an interview. The carrier expects to have a fleet of 50 planes by 2030. Growing beyond that will depend on Virgin securing slots at London’s Heathrow airport, Weiss says. The carrier doesn’t have any plans to return to London’s Gatwick airport, which it pulled out of during the pandemic.

Global Airline Profit Estimate Jumps (9:40 a.m.)

Global industry profits are now expected to reach $9.8 billion this year, more than double the $4.7 billion forecast in December, the International Air Transport Association said in a statement Monday. IATA expects some 4.35 billion passengers to travel in 2023, around 96% of 2019 levels.

“Taking everything into account we believe this will be a good year for aviation,” Willie Walsh, the director general of IATA, said.

Qantas Faces Shorter Delay (9:30 a.m.)

Qantas will receive deliveries of Airbus’s new longest-range single-aisle A321XLR jet six months later than planned, a timeframe that’s better than the industry average, the carrier’s CEO-designate Vanessa Hudson said on Monday.

Australia’s flag carrier also said that its planned direct services connecting Sydney with New York and London are likely to cost 20% more than flights to the same destinations with one stop.

Summer Air Travel Will Be Better (8:55 a.m.)

This summer will be better than last for air travel, but there are still challenges in areas such as air-traffic control and strikes in France, IAG CEO Luis Gallego says in interview with Bloomberg TV.

Airbus Widebody Crunch (Sunday 7:55 p.m.)

Airbus said the widebody aircraft market is set to experience similarly lengthy wait times as the workhorse single-aisle segment because airlines are rapidly stocking up on long-haul jets, while supply disruptions on equipment like seats limits output.

The European planemaker is already sold out of its bestselling A321neo aircraft until 2029, and Scherer said the company will focus on offering its more expensive twin aisle models to “proven partnerships” rather than “chasing every opportunity that presents itself.”

$5 Trillion Required (Sunday 6 p.m.)

A cumulative $5 trillion will be needed for aviation to achieve net zero by 2050, according to the latest forecast from IATA, which on Sunday released a series of roadmaps toward the goal. This amount would cover technological advancements, infrastructure developments and operational improvements.

“I must emphasize that the roadmaps are not just for airlines,” IATA’s Walsh said. “Governments, suppliers and financiers cannot be spectators in aviation’s decarbonization journey. They have skin in the game.”

JetBlue Weighing Options (Sunday 5:26 p.m.)

JetBlue Airways Corp. said it’s weighing its options after a US judge ruled the Northeast Alliance (NEA) between the carrier and American Airlines Group Inc. broke antitrust law and ordered the pair dissolve the arrangement within 30 days.

JetBlue expects to make a decision regarding its next steps “soon,” Chief Executive Officer Robin Hayes said in an interview with Bloomberg Television on the sidelines of the IATA annual general meeting in Istanbul on Sunday.

American Airlines and JetBlue use the Northeast Alliance, struck in 2020, to coordinate flights and pool revenue, arguably allowing them to compete more effectively against United Airlines Holdings Inc. and Delta Air Lines Inc. in Boston and the New York city area.

Thai Airways Plans Order (Sunday 12:12 p.m.)

Thai Airways International Pcl said it will begin talks with aircraft manufacturers to purchase 30 new widebody jets as tourists return to Thailand and the carrier looks to rebound from the pandemic.

The airline will formally send out a so-called request for proposal to both Airbus SE and Boeing Co. next week for aircraft it expects to receive starting in 2026, Chief Executive Officer Chai Eamsiri said in an interview in Istanbul on Sunday.

--With assistance from Will Davies, Angus Whitley and Anthony Palazzo.

©2023 Bloomberg L.P.