Mike Cagney’s Figure Technology Taps Tannenbaum as Its New CEO

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

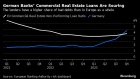

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Sep 22, 2021

, Bloomberg News

(Bloomberg) --

Health-care property company Icade Sante SAS and its holders are seeking as much as 902 million euros ($1.05 billion) in a Paris initial public offering as demand from Europe’s aging population grows.

Existing holders are seeking as much as 102 million euros from the offering, according to terms seen by Bloomberg News, while the new company is looking to raise 800 million euros. The offering values Icade Sante at as much as 6.4 billion euros.

Icade Sante owns medical surgeries, post-acute mental-health facilities and nursing homes that are rented to health-care companies on long leases. It has been expanding internationally since 2018, snapping up portfolios of nursing homes in Italy, Spain and Germany to add to its predominantly French holdings.

Shares in the IPO are being marketed at 115 euros to 135 euros each through Sept. 30, with the new stock to start trading on Oct. 1. Underwriters can opt to sell additional shares, boosting the deal size to as much as 992 million euros.

Icade’s offering is the largest in an increasingly crowded Paris IPO market. Private equity firm Antin Infrastructure Partners SA, cybersecurity firm Exclusive Networks and cloud-storage firm OVH Group SAS are also tapping public investors amid a global listings boom.

BNP Paribas SA, Credit Agricole SA, JPMorgan Chase & Co. and Societe Generale SA are global coordinators, while Bank of America Corp., Natixis SA and UBS Group AG are bookrunners.

©2021 Bloomberg L.P.