Mar 23, 2019

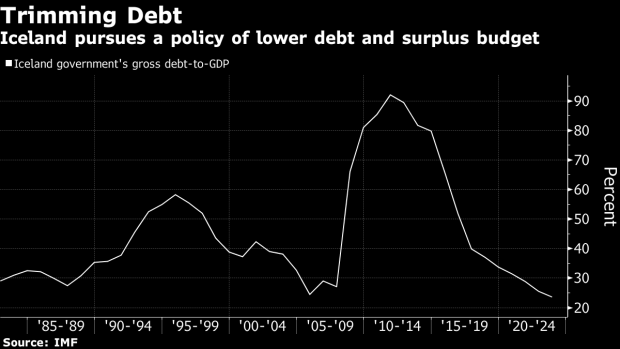

Iceland to Maintain Budget Surplus Through 2024 Despite Slowdown

, Bloomberg News

(Bloomberg) -- Iceland will continue to reduce public debt and sustain a budget surplus even as it lowers taxes in the next five years, Finance Minister Bjarni Benediktsson said.

The plan is part of a financial road map that envisages a Treasury surplus of 0.8 percent to 1 percent of gross domestic product between 2020 and 2024, the minister said in an interview. The program includes tax breaks for households and companies, boost to housing and transport services and a fund to protect the nation from financial shocks.

The balancing act between austerity and the proposed fiscal concessions means less room for the government to sustain a high interest outgo or step up other spending to boost slowing economic growth. A potential bankruptcy of one of the country’s two airlines and stalled wage negotiations for a large part of the workforce also cloud the outlook.

“We will need to impose certain measures of restriction,” Benediktsson said. The government may have to seek cost savings of as much as 5 billion kronur ($42 million), he said.

Growth in the smallest Nordic economy will cool to 1.8 percent this year, the slowest pace since 2012, according to projections by the Central Bank of Iceland. Inflation fell to 3 percent in February when the trade balance swung to a deficit.

“If there will be major setbacks which will wipe out all foreseeable economic growth then we need to adjust to that and if that happens I see no other option than to cut back on spending,” Benediktsson said.

Sacrificing the surplus would however be a bigger decision he notes as that would entail changing the financial policy “which there are no plans for changing unless the fundamental preconditions change.”

The financial plan projects a decrease in taxes as well as the Treasury’s debt levels and interest burden. It also expects the bank tax to be lowered in four steps between 2020 and 2023 from 0.376 percent to 0.145 percent.

To contact the reporter on this story: Ragnhildur Sigurdardottir in Reykjavik at rsigurdardot@bloomberg.net

To contact the editors responsible for this story: Dana El Baltaji at delbaltaji@bloomberg.net, Srinivasan Sivabalan, Crystal Chui

©2019 Bloomberg L.P.