Billionaire Stephen Ross Believes in South Florida—and Is Spending Big to Transform It

The Related Cos. founder is following the money flowing south by bringing his influence to everything from real estate to schools and health care.

Latest Videos

The information you requested is not available at this time, please check back again soon.

The Related Cos. founder is following the money flowing south by bringing his influence to everything from real estate to schools and health care.

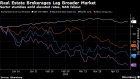

Real estate brokerage stocks tumbled Thursday on waning expectations for Federal Reserve interest-rate cuts, and as a disappointing earnings release raised concern about the sector’s outlook.

Initial data on US gross domestic product for the first quarter of 2024 is set to confirm an ongoing economic boom amid a tailwind from surging immigration.

A South Florida office skyscraper from Related Cos. landed new finance tenants, including a John Paulson business and a private equity firm that counts Mark Bezos as a founding partner.

Oracle Corp. is moving its headquarters out of the city. Tesla Inc. is pulling back after a rapid expansion. Almost a quarter of commercial office space is vacant, and nowhere in the country have residential real estate prices fallen further from their pandemic peak.

Dec 9, 2021

, BNN Bloomberg

Canada’s biggest pension fund is open to investing in the country’s rental market to help increase much-needed housing supply – “if the opportunity exists.”

In an interview, the head of CPP Investments’ real estate unit did not shut the door to the idea of pursuing investments in the domestic single-family rental market, much like the pension fund is doing in the United States.

On Wednesday, the Canada Pension Plan Investment Board announced a joint venture with Greystar Real Estate Partners LLC to build and acquire single-family rental communities in the U.S.

CPPIB, which had $541.5 billion in assets as of September, will own a 95 per cent stake in the venture and Greystar will own the remaining five per cent. A total of US$840 million in equity is being poured into the deal.

“Currently, we’re focused on the U.S. The U.S. is a larger market and so it does present larger opportunities. And as big investors, we do look for opportunities where we can invest at scale,” said Peter Ballon, global head of real estate for CPP Investments, in an interview Thursday.

“Having said that, single-family rentals are, as I mentioned earlier, an attractive opportunity for a lot of renters. And while we’re currently not focused on it, I can imagine that this segment could grow here in Canada.”

Ballon said that the deal with Greystar is beneficial for Americans because the two entities are teaming up to build more rental stock – not competing against renters for existing homes.

Increased housing supply has been one of the solutions many Canadian real estate experts have called for to improve affordability.

Ballon said he wasn’t aware of any Canadian government discussions happening with pension funds or other institutional investors to increase the country’s housing supply, but said “that doesn’t preclude us from pursuing that if the opportunity exists in Canada.”

“We think [the global residential sector] offers great opportunities across the full segment of residential and we’ve been an active investor in multi-family apartment buildings for a long time. So this is just a natural extension of taking advantage of other vehicles to access the residential market, and single-family is particularly attractive these days,” he said.