Mar 31, 2023

IMF Needs Billions From Rich Nations to Help Poorest Countries

, Bloomberg News

(Bloomberg) -- The International Monetary Fund is calling on its wealthier member nations to contribute to a trust for the poorest countries that is short billions of dollars at a time of rising demand from economies in debt distress.

The IMF needs about $6.3 billion to meet its fundraising target for the Poverty Reduction and Growth Trust, its main vehicle for providing interest-free loans to the lowest-income countries, Managing Director Kristalina Georgieva said in a blog post on Friday ahead of the institution’s Spring Meetings next month.

The trust is divided in two parts: loans that the IMF gets from its rich members, and subsidy or grant resources, which must come from funds from nations’ fiscal budgets. The shortfall stems from greater loan demand from poor countries since the onset of the Covid-19 pandemic, and the impact of higher interest rates.

The loan portion is often easier to meet, with IMF members lending reserves called special drawing rights that they originally received from the fund and would otherwise hold on their central bank balance sheets. But the grant resources are harder to come by in an era where higher interest rates and slower growth strain federal budgets across the world.

While the IMF has reached about three quarters of the loan resources it’s seeking to raise, it’s received less than half of the subsidy resources, Georgieva said.

The trust is designed to be self-sustaining. The IMF pays interest on the funds that it receives from its members and then lends on at zero interest, and the grant resources cover that gap. The Washington-based fund is currently short about $1.6 billion in those grant pledges, despite commitments already made such as about $100 million by the European Union last October and $80 million from Japan last April.

The trust is in “urgent need of replenishment,” Georgieva said in a blog post on Friday, calling the funding “a matter of utmost priority.”

“A failure to secure these resources would jeopardize the IMF’s ability to provide much-needed support to low-income countries as they seek to stabilize their economies in an increasingly shock-prone world,” Georgieva said. “The message is clear: Our membership must come together and step up support for these vulnerable countries.”

Georgieva said about 15% of low-income countries are already in debt distress and another 45% face high debt vulnerabilities. As global interest rates rise, this increases risks and restricts fiscal space to respond.

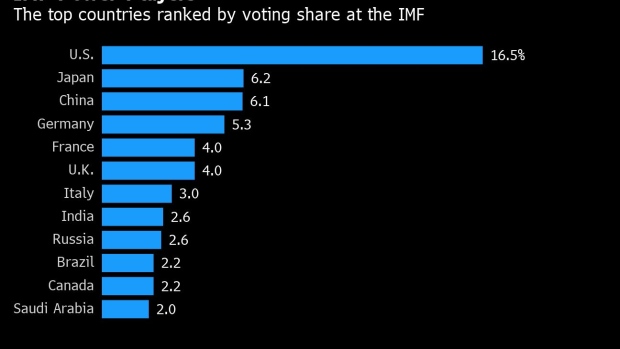

A more diverse group of creditors than in the past is complicating the restructuring process for countries that can’t pay. The IMF, World Bank and Group of 20 chair India will convene their Global Sovereign Debt Roundtable on April 12 at the Spring Meetings to try to reach greater consensus, Georgieva said.

©2023 Bloomberg L.P.