Oct 12, 2021

IMF Sees Risk of ‘Sizable’ Selloffs in Stocks, Housing Market

, Bloomberg News

(Bloomberg) -- The International Monetary Fund warned of the risk of sudden and steep declines in global equity prices and home values as the Federal Reserve and other central banks withdraw the support they’ve provided during the pandemic.

Ultra-easy monetary policy has led to “pockets of market exuberance and rising financial leverage” that could unwind in disorderly ways and put the economic recovery at risk as credit tightens, the IMF said on Tuesday in its semi-annual Financial Stability Report.

“Shocks could be coming from the central banks themselves because they’re tightening more quickly than previously anticipated,” Tobias Adrian, director of the Monetary and Capital Markets Department at the IMF, said in an interview. “We worry that we could see a sell-off of sizable magnitude, given the level of stretched valuations.”

Complicating the central banks’ calculus, he said, is the emergence of inflation pressures “unlike anything we’ve seen before.”

While the IMF agrees with the Fed and other central banks that the burst of inflation will likely prove temporary, “there’s quite a bit of uncertainty” around that forecast, Adrian said. That raises “some question marks” about how policy makers would respond to a financial-market meltdown.

Here are some of the financial stability risks highlighted in the IMF report:

Stock Markets

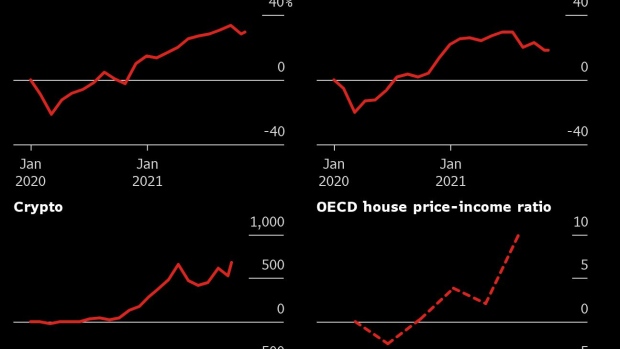

“Equity price misalignments” are widespread as the run-up over the last 18 months has left shares elevated relative to economic fundamentals.

Prices could fall “substantially in the event of a sudden reassessment of the economic outlook or unexpected policy changes.”

Housing Markets

“Downside risks to house prices appear to be significant. In a worst-case scenario, the house price decline over the next three years is estimated to be about 14% in advanced economies and 22% in emerging markets.”

One silver lining: While home values look about as stretched as they did before the 2007-08 financial crisis, the banking system is in much better shape than it was back then. according to the Fund.

Cryptocurrencies

While the crypto asset market has mushroomed to more than $2 trillion, it’s still small when compared with global stock and bond markets and doesn’t yet pose a risk to the overall stability of the world financial system.

But regulation is urgently needed, especially of stablecoins, to mitigate against such dangers in the future. “With limited or inadequate disclosure and oversight, the crypto ecosystem is exposed to consumer fraud and market integrity risks,” the IMF said.

©2021 Bloomberg L.P.