Mike Cagney’s Figure Technology Taps Tannenbaum as Its New CEO

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Jan 20, 2022

, Bloomberg News

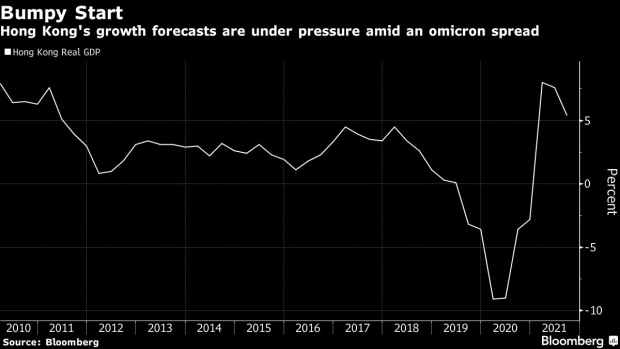

(Bloomberg) -- The balance of risks facing Hong Kong’s economy are tilted to the downside, the International Monetary Fund warned in its annual assessment of the finance hub.

Risks to the economy include ongoing uncertainty linked to the pandemic, which could impact the flow of people and further weigh on consumption, the IMF said in its report. The Washington-based lender is forecasting economic growth to slow to 3% this year from an estimated 6.4% in 2021.

Economists have started downgrading their forecasts for Hong Kong as strict virus control measures, including travel bans, curb tourism and retail spending in the city. Citigroup Inc. also warned this week of rising prices and possibly shortages of some goods this year as airlines slash cargo flights into the hub.

Other downside risks highlighted by the IMF include a slower-than-expected global recovery, continued disruption of global supply chains and de-globalization and decoupling that could reduce the flow of goods and derail the recovery, according to the IMF report.

“A sharp rise in global risk premia, a disorderly tightening in the monetary policy of major advanced economies, large housing market corrections, escalating U.S.-China tensions, and a shift of market confidence in Hong Kong SAR’s status as a major international financial center could affect the flow of capital,” the IMF said.

The analysis comes as Hong Kong sticks to an aggressive strategy to control the virus. A survey released this week by the American Chamber of Commerce in Hong Kong found that the city’s stringent travel restrictions are now the biggest challenge for U.S. businesses and expatriates in the city, with 44% of respondents in a new survey saying they’re likely to leave.

In its assessment, the IMF said ample policy buffers and a strong external position should help to offset any adverse impact on Hong Kong’s financial stability and economic growth.

A quicker re-opening of borders could drive a stronger recovery in private consumption, the IMF said.

“A faster-than-expected global recovery could contribute to stronger export growth than currently envisaged,” the IMF said, adding that the development of the Greater Bay Area could improve medium- and long-term growth prospects.

On fiscal policy, the Hong Kong government should pursue a gradual return to a balanced budget and should focus on more targeted support.

“Fiscal policy should also address structural challenges of population aging, high income inequality, and insufficient public housing supply to promote inclusive growth,” the IMF said.

©2022 Bloomberg L.P.