Jan 14, 2022

In a Sea of Red, Two Emerging Markets Stand Out as Vulnerable

, Bloomberg News

(Bloomberg) -- As the spike in U.S. Treasury yields turns bond trading screens red worldwide, two countries in particular face a stormy year ahead -- Brazil and Colombia.

Bonds in the two South American nations tumbled this month and are set to remain underperformers amid divisive elections, mounting fiscal debts and in the case of Colombia, a widening current account deficit.

While local currency bonds in some countries are likely to retrace losses once the current spate of repricing is over, after their central banks hiked interest rates last year, Brazil and Colombia may head still lower. The yield on Colombia’s 2025 local-currency bonds jumped to above 8% this week from 7.4% at the start of the year. At the same time, yields on Brazil’s domestic notes due in the same year climbed beyond 11.50% from 10.65%, before trimming some of the move. Only Russia did worse amid pessimism over talks with the U.S.

“The headlines might get nasty and we’ll all be fed up with the election campaigns in a few months’ time,” said Viktor Szabo, an investor at Aberdeen Asset Management Plc. in London. “Political noise will be high.”

Investor concerns could also be seen in five-year swap rates, an indicator of perceived country risk. In Colombia, the five-year swaps have risen 73 basis points year-to-date, leaping 69 points in the first five trading sessions alone, the biggest weekly move since the start of the pandemic in March 2020. Brazil’s swap contract maturing in January 2027 rose as much as 88 basis points, before paring the move to 56 points this week.

Local Concerns

While bond markets in Mexico, Peru and Chile tracked global declines, for Colombia and Brazil the spike in U.S. yields added to a swathe of local concerns.

Colombia faces the first round of presidential elections in May with polls showing a clear lead for leftist Gustavo Petro. The candidate has said the government should borrow money from the central bank at zero interest rates, rather than tapping markets, and halt oil exploration.

“Because of the underlying fundamental conditions, Colombia cannot afford to have a regime change,” said Patrick Esteruelas, the head of research at Emso Asset Management. “It needs a credible fiscal anchor after losing investment grade.”

Both Fitch Ratings and S&P Global Ratings cut Colombia to junk status last year after a wave of street protests forced the government to backtrack on tax increases.

At the same time, Colombia’s current account deficit, a long-term concern of investors, gets wider and wider with dollars flowing out of the economy. The deficit broadened to 5.1% of the country’s gross domestic product in the third quarter of 2021 from 4.3% in the previous three months. It probably reached about 5.6% in the fourth quarter, according to the central bank.

“The widening current account makes Colombia even more vulnerable to the tightening of external conditions than other countries in the region,” Olga Yangol, head of emerging market research at Credit Agricole SA in New York, wrote in a note.

Economic Decline

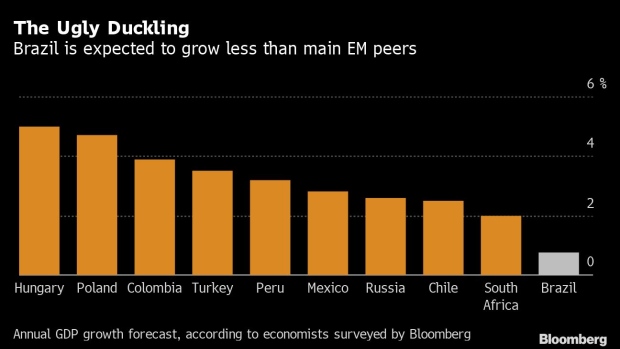

Brazil may be in an even worse position. It’s economy is expected to expand 0.75% this year, less than any close emerging-market peer, according to economists surveyed by Bloomberg. At the same time, traders will have to deal with a polarized presidential election in October and constant threats to the government’s fiscal rules.

The election is likely to pit current President Jair Bolsonaro against former leftist leader Luis Inacio Lula da Silva. Investors aren’t even sure which one markets should back.

While Lula pursued largely market-friendly policies during his two terms in office, that may change if he receives a third mandate as his party is pledging to review the pension reform and spending cap bills approved in the past six years.

At the same time, Bolsonaro has failed to convince investors that he is a safe pair of hands when it comes to government finances, moving to change the fiscal rules to allow him to spend more and improve his odds in the presidential race.

“In Brazil, we expect a noisy and polarizing environment leading up to the October 2022 presidential elections,” Gramercy Funds Management’s chief investment officer, Robert Koenigsberger, wrote in the firm’s quarterly outlook Wednesday. “Investors will be looking for signals on economic policy priorities from the main candidates in the context of projected flat GDP growth and a challenging fiscal outlook.”

©2022 Bloomberg L.P.