Jan 28, 2021

In the Race for Investment Dollars, Cars Are Pulling Ahead

, Bloomberg News

(Bloomberg) --

You may have seen that investment in the transition to carbon-free energy—in renewables, electric heat, energy storage, and electrified transport—topped a half-a-trillion dollars in 2020. The projects and technologies financed by that big money will reduce the carbon intensity of things like generating power, heating buildings, and moving us around for years to come.

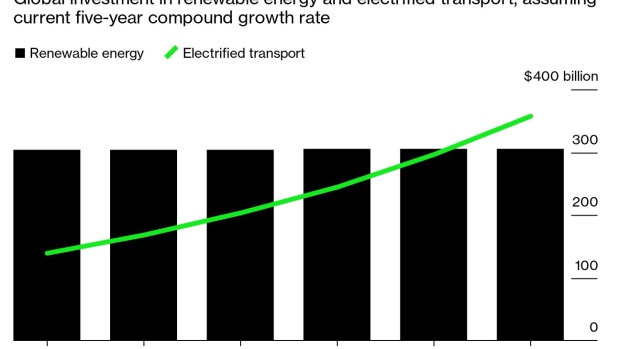

As I noted last week, though, there are two very different trends at work within that large topline figure. Investment in renewable energy has been flat for years, while investment in electrified transport is soaring. The former is still much larger than the latter, but that might not be the case for too much longer.

Here’s the gist in two numbers. The five-year compound average growth rate in clean energy investment is 0.15%, while the rate for electrified transport is 20.74%. Apply those growth rates to last year’s investment totals and there’ll be substantially more investment in electrified transport than in renewable energy by 2025.

That’s not a particularly bold claim. If anything, it’s probably conservative. BloombergNEF analysts are still tallying December 2020 electric vehicle sales, but it looks like they’ll come in higher than even year-end projections. In 2021, BNEF expects 4.4 million electric vehicles sold, which would likely push the total investment in electrified transport over $200 billion and pull the date it’ll cross renewable energy back to 2023.

There are a few things to keep in mind as we consider the implications of this investment flip. First, transport is hedonic—that is, we consumers ascribe much more value than just cost to our vehicles. Comfort, convenience, sound, speed, appearance, social signals, and so on all come into play. While it’s certainly possible to ascribe value to the appearance of a solar panel or a wind turbine, it’s not the same as the signals sent by the brand and style of a car or truck.

That can even extend to less tangible things like emissions. The gaseous and particulate byproducts of transportation have major environmental impact, but you and I have no way to sense that. What we do sense, however, are noise, vibration, smell, and dirt. Electrified transport addresses the sensory and suprasensory downsides of internal combustion all at once.

The second thing to keep in mind is that the transport market is highly distributed, and much more financially accessible. Big renewable energy projects are multi-million-, or even billion-dollar assets, financed and built and maintained by professionals. There are more than two million home solar installations in the U.S., but it took decades for the industry to reach that number, and it will probably never grow to the same scale as the U.S. passenger vehicle market. Meanwhile, the global auto industry sells about 80 million new vehicles a year, and there are more than a billion cars on the road today.

The third is essentially a cross-referencing of the first two: The combination of transport’s hedonic nature and broad distribution means we need to expand our sense of where electrification might show up next.

In heavy trucking, leaders like Scania have done the math and concluded that “battery electric vehicles will be the main tool” to create a sustainable transport system. But electrification is also incipient in marine transport, where Norway alone has more than 30 operational electric ferries, with nearly the same number to be added to the fleet this year—according to data from Rystad Energy’s Marius Kluge Foss, the country has already largely shifted its ferry contracts to electric vessels. Then there are things like excavators, which sit at the edge of transport but at the core of industrial activity. Perhaps we should also include transport applications on snow and water, which are individually small but potentially significant in the aggregate.

Here is what I expect in the next few years: a further proliferation of new types of electrified transport, in new markets, with an increasingly large pool of buyers. Many of those buyers will be enthusiasts, ready to get into the new new thing in transport, but a lot of them will be accountants, too: professionals who run the numbers and see a bottom-line benefit for their companies. Those are the trends that make a growing market, and in not too many years, the biggest market in the global energy transition too.

Nathaniel Bullard is a BloombergNEF analyst who writes the Sparklines newsletter about the global transition to renewable energy.

©2021 Bloomberg L.P.