Jan 9, 2020

Incoming OMERS CEO to maintain steady hand on pension plan amid global turmoil

, BNN Bloomberg

OMERS incoming CEO says pension plan set to grow to $200B in 8 years

The incoming chief executive officer of the Ontario Municipal Employees Retirement System is not going to let geopolitical risks force his hand when it comes to investment decisions.

Speaking to BNN Bloomberg a day after Iran launched more than a dozen ballistic missiles at a U.S. army base in Iraq, Blake Hutcheson said he’s not in the business of speculating on tomorrow’s news. Hutcheson will officially succeed outgoing OMERS CEO Michael Latimer on June 1.

“We're not in the business of saying this person will be elected, or this person will be taken out for whatever reason, or somebody may drop a bomb,” Hutcheson told BNN Bloomberg’s Amanda Lang in an interview taped Wednesday.

“You just have to have a portfolio and a plan that sees through cycles.”

“None of us want to react to today’s news or tomorrow’s news.”

OMERS, one of the biggest pension funds in the country, saw its net assets grow to $100 billion from about $60 billion under Latimer’s six-year watch. Hutcheson said while he sees opportunities in Asian markets, he’s also not turning his back on the pension plan’s home turf.

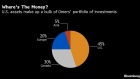

“We’re growing in Canada. We’re growing in Europe and to a large extent we’re growing in the U.S., but our big growth will be in the high-growth stories in India and pockets of Asia,” Hutcheson said, noting that 30 per cent of the fund’s portfolio remains in Canada compared to just five per cent in Asia.

“That doesn’t mean we become any less Canadian. It doesn’t mean we forget our roots and it doesn’t mean we will ignore Canada in any way.”

One place he is unlikely to invest, however, is the cannabis space as Canada’s burgeoning industry reels from a disastrous 2019.

“It’s small-cap stuff,” Hutcheson said. “It does come with noise. We are so confident in the areas [in which] we have great expertise, it’s not something we have felt we need to look at.”