Apr 14, 2023

Increase in US Bank Loans and Deposits Signal Some Stability

, Bloomberg News

(Bloomberg) -- US bank lending rose for the first time in three weeks and deposits increased, suggesting credit conditions are stabilizing after a string of bank failures last month.

Commercial bank lending increased $10.2 billion in the week ended April 5, according to seasonally adjusted data from the Federal Reserve out Friday. On an unadjusted basis, loans and leases fell $5.6 billion.

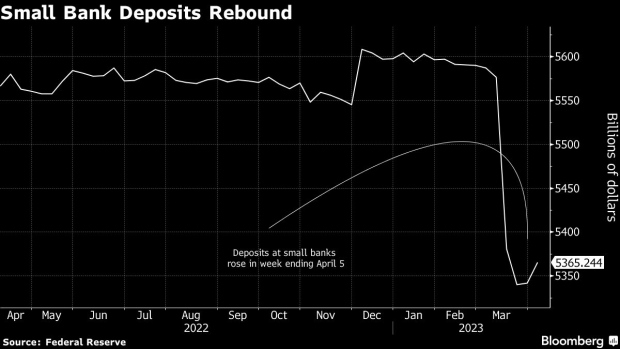

Bank deposits climbed by nearly $61 billion. Before seasonal adjustment, they increased $75.2 billion. Deposits had been gradually retreating since peaking in April 2022, but the pace of that decline accelerated in March.

The gain in adjusted lending reflected increases across banks of all sizes. Commercial and industrial loans picked up for the first time in three weeks, and commercial real estate lending improved slightly. Residential real estate loans eased.

In the latest week, the pickup in deposits reflected increases at both large and small banks, as well as foreign institutions. In a welcome sign, deposits at smaller banks rose by the most this year, although they still remain well below levels seen prior to the recent financial stress.

To gauge credit conditions, economists are closely monitoring the Fed’s so-called H.8 report, which provides an estimated weekly aggregate balance sheet for all commercial banks in the US.

Lending is key to business growth and spending, and tighter loan standards are seen as a growing headwind for the economy in the months ahead.

For all of March, bank lending increased at a seasonally adjusted annualized rate of 5.7%. Deposits, however, plunged at an almost 22% pace — the largest monthly slide since 1981 as more funds flowed into money-market accounts.

The data come just hours after JPMorgan Chase & Co., Citigroup Inc. and Wells Fargo & Co. kicked off the industry’s quarterly earnings reports, with each finding ways to benefit from high interest rates. JPMorgan saw a surprise increase in deposits, and all three firms said income from lending jumped from a year earlier.

However, there are some signs of stress. Citi said provisions for loan losses more than doubled and JPMorgan boosted its pile of reserves for potentially soured loans.

What Bloomberg Economics Says...

“Evidence increasingly points to the banking-system turmoil remaining well contained, and the reprieve from accelerated deposit outflows is a welcome development for financial stability. Nevertheless, we expect the banks to continue contributing to tighter financial conditions by raising lending standards.”

— Stuart Paul, economist

To read the full note, click here

The slew of bank collapses led Fed officials to dial back expectations of how high they’ll need to lift interest rates, according to minutes of the central bank’s March meeting released earlier this week.

Taking into account an expected tightening of credit conditions for households and businesses, Fed staff advisers are now forecasting a “mild recession” later this year. Inflation, while showing some hints of moderation, remains well above the Fed’s 2% target.

It’s important to note that the H.8 report focuses on the commercial bank universe. When assets are divested to non-bank institutions — like in the case of the assets retained in receivership following the failure of Signature Bank — it can distort the picture.

The report is primarily based on data reported weekly by a sample of about 875 domestically chartered banks and foreign-related institutions.

For a list of banks commercial banks ranked by assets, click here.

--With assistance from Alex Tanzi and Augusta Saraiva.

(Adds Bloomberg Economics comment)

©2023 Bloomberg L.P.