May 11, 2022

India Central Bank Set to Raise Inflation Forecast in June

, Bloomberg News

(Bloomberg) -- India’s central bank will raise its inflation forecast in the June monetary policy meeting amid elevated commodity prices, possibly setting the stage for more interest rate increases by August, a person familiar with the matter said.

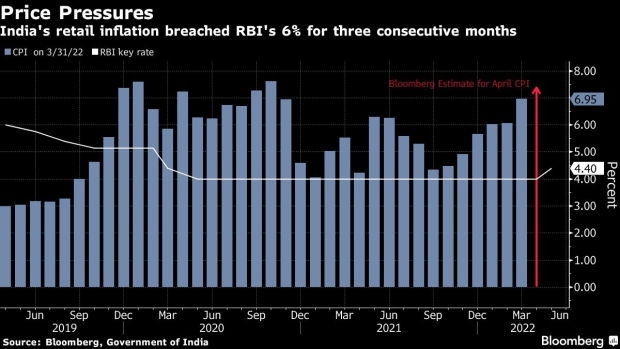

There is also a growing chance that inflation will breach the upper end of the Reserve Bank of India’s targeted 2%-6% range for the next two quarters as a shortage of coal and edible oils would feed into the readings, said the person who declined to be identified as the discussions are private.

Read: RBI Said to Extend Hikes on Worries Over Inflation-Target Breach

That means the inflation rate would have breached the RBI’s accepted range for three straight quarters, and the central bank will have to write a letter to the government, as laid down by law, explaining why it failed to keep costs under check. It will also have to lay out remedial measures.

The RBI raised key rates for the first time in nearly four years and moved to drain billions from the banking system in a surprise move last week to tame inflation. The decision stunned markets and pushed the benchmark 10-year bond yield to its highest in three years.

Governor Shaktikanta Das retained the April inflation forecast for the financial year through March 2023 at 5.7% but added there were “upside risks”.

India’s annual retail inflation in March rose to a 17-month high of 6.95%, a third straight month of staying above the mandated range. The CPI reading for April, due Thursday, is expected to show prices accelerated at its fastest pace since late 2020, according to the median estimate compiled by Bloomberg.

INDIA PREVIEW: CPI Inflation Likely Climbed to 7.3% Y/y in April

Increases in fuel and food prices, exacerbated by Russia’s invasion of Ukraine, sustained pandemic-related supply chain disruptions and Indonesia’s palm oil export ban have forced the central bank to act, the person said.

The move to tackle inflation, however, will come at the cost of thwarting a nascent recovery, the person said.

©2022 Bloomberg L.P.