Sep 20, 2019

India Cuts Tax on Goods and Services After $20 Billion Stimulus

, Bloomberg News

(Bloomberg) -- India reduced taxes on some hotel and catering services, and a levy on some passenger vehicles, adding to a surprise $20 billion tax break it offered to companies as part of efforts to revive demand in a slowing economy.

A panel of federal and state finance ministers on Friday decided to lower tax rate on some hotel services to 18% and catering services to 5%, Finance Minister Nirmala Sitharaman told reporters after a meeting of the Goods and Services Tax council in Panaji, Goa. The new rates will take effect on Oct. 1.

“Many of the decisions are driven by the broader principle of promotion of tourism,” Sitharaman said. The decisions by the GST panel were taken to make the economy more vibrant and rationalize taxes, she said.

While the panel decided against reducing tax on cars fearing a huge revenue outgo, Sitharaman announced that an additional levy of 15% on some passenger vehicles designed to carry 10-13 people would be cut to 1% for petrol vehicles and 3% for diesel. The auto sector which has been reeling from the worst slump on record had asked for reduction in GST rate to 18% from 28% at present.

Key Insights

- Tax rate on some goods were increased, including GST on caffeinated beverages -- to 28% from 18%, with an additional levy of 12%

- The measures come shortly after Sitharaman lowered the tax rate for companies by almost 10 percentage points, bringing the effective rate to 25.17%, which will cost the government $20 billion in revenue

- Today’s tax measures are bound to strain the finances of the government, which targets to narrow its budget deficit to 3.3% of gross domestic product in the year to March

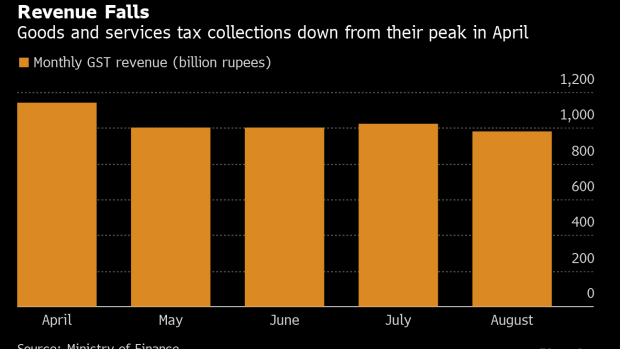

- The government has projected a more than 11% increase in its overall tax collections this year, based on economic expansion of 7%, which is now seen coming down to 6%. The tax mop-up in the four months through July was only a fifth of the budget target of 16.5 trillion rupees

- The economy expanded at 5% in the quarter to June, the weakest pace since May 2013 amid waning demand and anemic investment activity

Get More

- Return filing waived for companies with less than 200 million rupees revenue

- GST rate on railway coaches and wagons raised to 12% from 5%

- Jewelry exports won’t attract GST

--With assistance from Nupur Acharya.

To contact the reporters on this story: Shruti Srivastava in New Delhi at ssrivastav74@bloomberg.net;Vrishti Beniwal in New Delhi at vbeniwal1@bloomberg.net

To contact the editors responsible for this story: Nasreen Seria at nseria@bloomberg.net, Karthikeyan Sundaram

©2019 Bloomberg L.P.