Jan 16, 2019

India Equities Rise Amid a Mixed Start to Local Earnings

, Bloomberg News

(Bloomberg) -- Indian equities rose a second day, ignoring a weak opening in Asian counterparts, as investors assessed local companies’ earnings. Two of the top four companies that have reported so far have beat estimates.

The benchmark S&P BSE Sensex gained 0.2 percent to 36,379.58 as of 10:20 a.m. in Mumbai, extending gains for a second day. The NSE Nifty 50 Index also added 0.2 percent.

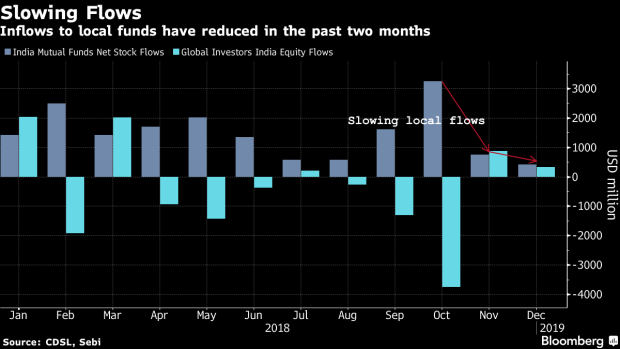

A national election, along with a shrinking pool of cash as central banks across the world trim balance sheets, suggests 2019 will be challenging for Indian equities. Local flows are also showing signs of fatigue as stock funds received the smallest inflows in 23 months through December. Some analysts expect Indian equity gauges to remain in the doldrums until the poll results become clear, around May.

Read: Party Over for Indian Stocks as Global Cash Shrinks, BofAML Says

Strategist Views

- “Markets have been trading in a narrow range, reflecting indecisiveness ahead of Indian elections,” said Jagannadham Thunuguntla, senior vice president and head of research for wealth at Centrum Broking Pvt. in Mumbai. “The ongoing earnings season is keeping investors busy with stock-specific action.”

- Better-than-expected earnings growth will cushion the market, while challenges will arise with any weakening of the rupee against the dollar or a rebound of crude oil prices. Advises investors to pick shares of companies with low debt, wider profit margins and highest return ratios.

- “Keep dry powder ready to take advantage of any volatility.”

The Numbers

- Eighteen of the 19 sector indexes compiled by BSE Ltd. advanced, paced by a gauge of utilities.

- Zee Entertainment Enterprises Ltd. gained as much as 4.2 percent, among the top gainers on Nifty.

- Indo Rama Synthetics India Ltd. climbed 4.9 percent to its highest since February 2018, after a unit of Indorama Ventures said said it plans to buy a stake.

- Speciality Restaurants Ltd. surged by its daily limit, a record, after its October to December sales jumped 24 percent from a year earlier and its net income rose nearly 13 times.

- Of the four Nifty 50 companies that have reported earnings so far, two have topped analyst estimates and two have trailed, according to data compiled by Bloomberg.

Analyst Notes/Market-related Stories

- SBI Life Rated New Underperform at Macquarie; PT 555 Rupees

- AIA Engineering Upgraded to Buy at Nomura; PT 1,945 Rupees

To contact the reporter on this story: Ameya Karve in Mumbai at akarve@bloomberg.net

To contact the editors responsible for this story: Divya Balji at dbalji1@bloomberg.net, Anto Antony, Margo Towie

©2019 Bloomberg L.P.