May 4, 2022

India Hikes Rate in Surprise Move as Inflation Fight Intensifies

, Bloomberg News

(Bloomberg) -- India’s central bank raised its key policy rate in a surprise move Wednesday, sending bond yields higher, as it intensified the battle against inflation that’s outpaced its expectations for much of the year.

In its first unscheduled rate change since the depths of the pandemic, the Reserve Bank of India increased its repurchase rate to 4.40%, from the record low 4% its been held at for the past two years to support the economy.

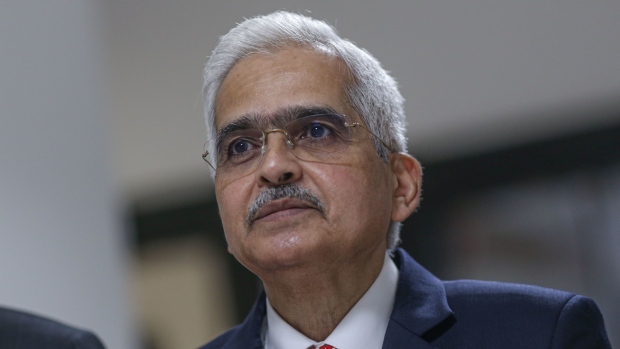

Persistent inflation pressures are becoming more acute, Governor Shaktikanta Das said in an online briefing, adding that there is a risk prices stay at this level for “too long” and expectations become unanchored. The bank’s next scheduled rate decision isn’t until June 8.

RBI policymakers have begun signaling recently that higher rates were in the works as consumer prices breached the upper limit of the bank’s target through the first quarter of 2022.

The move also comes ahead of the Federal Reserve’s rate decision on Wednesday, which is expected to see the U.S. central bank’s most aggressive action to battle inflation in decades.

Increases in fuel and food prices, exacerbated by Russia’s invasion of Ukraine and sustained pandemic-related supply chain disruptions, have run hotter than the RBI had expected for much of this year. Headline inflation in March rose to a 17-month high of 6.95%, riding above the RBI’s 2%-6% target range for a third month.

After reaffirming its accommodative stance in February -- a step criticized by some economists as too benign on the risk of rising prices -- the central bank said last month that it would begin prioritizing inflation over supporting growth.

Read more: India’s RBI Signals Policy Shift With Focus on Liquidity, Prices

Since that pivot, traders began pricing in the most aggressive rate hikes in the region. Yields on the benchmark 10-year bond jumped as much as 28 basis points as Das spoke.

“The inflationary risks warrant a more aggressive and earlier tightening of monetary policy,” Nathan Sribalasundaram, India rates analyst at Nomura Holdings Inc. in Singapore, said before the briefing.

In an interview late last month, Jayanth Rama Varma, one of the most hawkish members of the RBI’s rate-setting committee, signaled that the bank was ready to increase borrowing costs. “All the groundwork has been laid,” he said. “The liquidity normalization has happened, the forward guidance has been dropped, we are now completely free to act.”

Another member of the Monetary Policy Committee, Shashanka Bhide, said in a separate interview that policymakers had been “a little surprised” by the rise in food prices.

The RBI in April raised its inflation forecast to 5.7% for the fiscal year that started April 1, up from its 4.5% in February, and said it sees gross domestic product growth during the year at 7.2%, compared with a previous expectation of 7.8%.

©2022 Bloomberg L.P.