Aug 26, 2022

India May Be on the Cusp of Private Investment Revival

, Bloomberg News

(Bloomberg) -- India is showing nascent signs of reversing a troubling trend as private investment picks up, aided by improving consumption and softening inflation, data show.

“I am cautiously optimistic about growth with some signs of gradual, though uneven, revival of consumption demand,” said Jayanth Rama Varma, an external member of India’s monetary policy committee. A modest increase in private capital spending is counted on to support the recovery, he said in an interview earlier this month.

Private investment in physical assets, including infrastructure, holds the key to sustaining India’s world-beating growth as fiscal room to boost spending remains limited. Investment has been on a decline for more than a decade as companies waited for durable demand and policy stability.

Businesses ramping up capacity as domestic demand recovers indicates early signs of a turnaround.

“A recovery in private capex is underway” as investments in infrastructure, manufacturing and technology services have picked up, Morgan Stanley economists led by Chetan Ahya wrote in a recent report, noting the growth in private projects under implementation has risen to a 10-year high of 9.2% at the end of June.

At the same time, capacity utilization of manufacturing firms has risen to a three-year high of 75% in three months to March, surpassing the pre-pandemic levels of 69.9% recorded during the January-March quarter two years ago, suggesting plans are being drawn for fresh investment.

The share of private sector proposal for new investments jumped to nearly 91% in April-June quarter, up from 78% during the previous quarter, data from the Centre for Monitoring Indian Economy Pvt. cited by rating company CareEdge showed.

Gross domestic product data due Aug. 31 will show how gross fixed capital formation -- a proxy for investment -- grew in April-June.

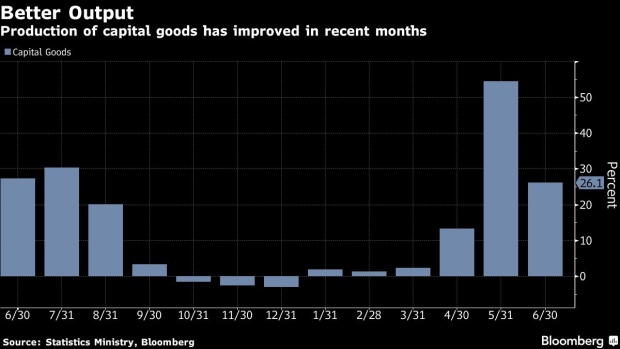

Output of capital goods -- physical assets used by businesses to produce goods and services -- has risen by double digits for three straight months after a slump in most part of the last two years. The strongest performance among the components of factory output helped the overall index perform better than expectations in June.

“We will get back to pre-pandemic level,” said Kamal Nandi, business head and executive vice president at Godrej Appliances. “Demand for appliances will go up and I think all brands have accordingly planned their expansions on capacity.”

Still, some companies are waiting for clear signs of lasting demand and the easing of supply chains impacted by the war in Ukraine and Covid-19 lockdowns in China. “The industry is yet to solve the disrupted supply chain challenges leading to shortages of key inputs,” said Shankar Raman, chief financial officer at Larsen & Toubro Ltd., India’s engineering conglomerate.

Bank credit increased 14.5% from a year earlier as of July 29, more than double the growth it saw a year ago. Some of it may have been fueled by higher working capital requirement, but “it is also a reflection of improved investment demand,” CareEdge said in a note.

Businesses in Asia’s third largest economy want to see price pressures ease some more to spur demand. Retail inflation cooled to a five-month low in July and further moderation is seen ahead. Car sales rose for a second straight month in July, indicating improving demand.

“Ultimately it is strength of demand conditions and its long-term stability which matter,” said Gaurav Kapur, Chief Economist of IndusInd Bank Ltd.

©2022 Bloomberg L.P.