Apr 22, 2021

India’s Massive Gold Imports Shows Asian Consumer Demand Returns

, Bloomberg News

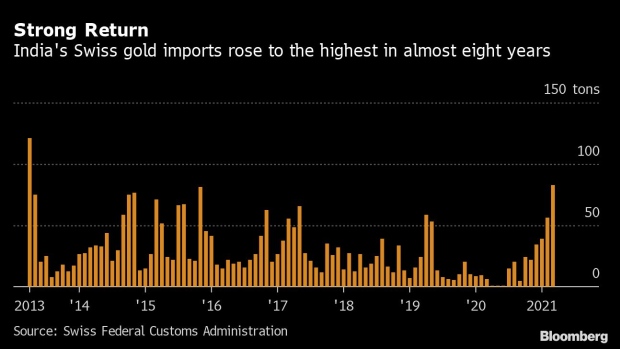

(Bloomberg) -- India’s gold imports from Switzerland surged to highest in almost eight years in March, in a sign that Asian consumers are once again a key pillar of support for the precious metal.

After a year on the sidelines -- during which exchange-traded fund buying drove bullion to a record -- Indian and Chinese consumers have rediscovered their appetite for gold. That’s helped bolster the precious metal this month after the worst first quarter in decades. Still, with India posting the world’s biggest one-day jump in Covid-19 cases on Thursday, the recovery in gold demand is about to be tested.

Spot gold fell 0.4% to $1,787.58 an ounce as of 10:42 a.m. in London, after earlier trading at an eight-week high.

Indian, the world’s No. 2 gold consumer, imported 82.6 tons from Switzerland last month, the most since April 2013, as jewelry buyers took advantage of the dip in prices during the ongoing wedding season.

China also boosted shipments from Europe’s premier gold-refining hub. Imports from Switzerland rose nearly fourfold to seven-month high of 9.3 tons, following the resumption of purchases in February. China’s has approved imports of about 75 tons a month to meet domestic consumption, according to people familiar with the matter.

Silver and platinum declined, while the Bloomberg Dollar Spot Index rose 0.1%.

Spot palladium fell 1.4% after touching a record high of $2,895.96 an ounce on Wednesday as a global economic rebound fueled expectations for increasing demand from automakers and concerns about a deepening supply shortfall.

The price of the metal used in catalytic converters to curb emissions in gasoline-powered vehicles is up 15% in 2021, building on a five-year rally. The bulk of palladium’s gains have come since mid-March after flooding at Russian mines run by MMC Norilsk Nickel PJSC curbed output.

©2021 Bloomberg L.P.