Dec 4, 2019

India’s Monetary Policy Should Remain Accommodative, OECD Says

, Bloomberg News

(Bloomberg) -- India’s central bank has room to ease interest rates further as lower oil prices have tempered inflation pressures, according to the Organisation for Economic Co-operation and Development.

“Monetary policy should remain accommodative as long as inflation is set to remain comfortably close to the target,” OECD said in its Economic Survey of India.

The view is published less than two hours before the Reserve Bank of India‘s monetary policy decision Thursday, where it is expected to reduce borrowing costs even after inflation breached its medium-term target. Governor Shaktikanta Das has vowed to keep easing for as long as necessary to revive growth in Asia’s third-largest economy, whose expansion cooled to a new six-year low of 4.5% in the quarter ended September.

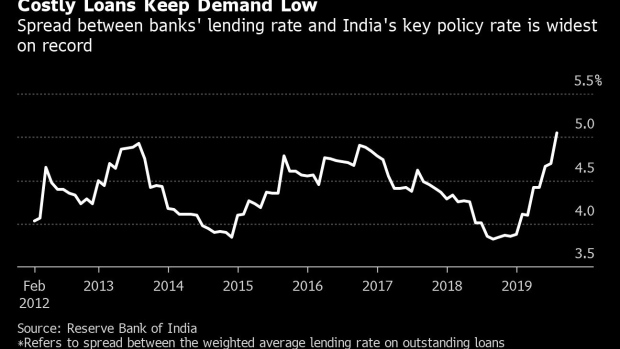

The OECD said monetary policy transmission remains incomplete and suggested reducing the spread between administered rates on small savings and market rates.

The spread between the central bank’s key policy rate and the weighted average lending rate on outstanding loans from commercial banks is the highest in data going back to February 2012.

The Paris-based organization also raised concerns on off-budget spending by the government. India’s real fiscal gap, including off-budget borrowings of 540 billion rupees ($7.6 billion), is seen at 3.55% of gross domestic product in the year to March 2020, according to the finance ministry’s estimates, compared with its 3.3% headline target.

“Improve transparency on off-budget transactions and contingent liabilities, for example, by creating an independent fiscal council,“ the OECD said. It also suggested raising “more tax revenue by removing the tax expenditures that most benefit the rich, freezing nominal personal income tax brackets and improving compliance.”

To contact the reporter on this story: Vrishti Beniwal in New Delhi at vbeniwal1@bloomberg.net

To contact the editors responsible for this story: Nasreen Seria at nseria@bloomberg.net, Karthikeyan Sundaram, Jeanette Rodrigues

©2019 Bloomberg L.P.