Jan 22, 2019

India Stocks Swing as Investors Weigh Trade Talks, Global Growth

, Bloomberg News

(Bloomberg) -- Indian equities fluctuated as investors continued to assess the outcome of China-U.S. trade talks and the outlook for global growth.

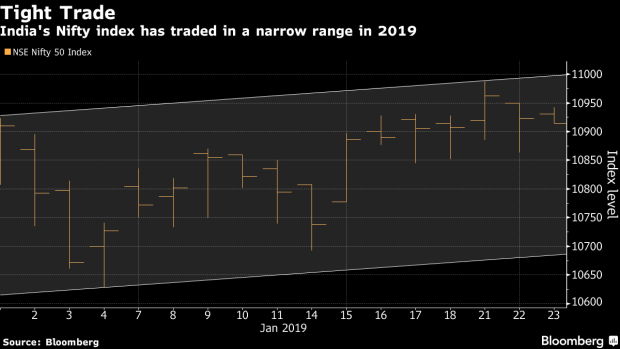

The benchmark S&P BSE Sensex fell less than 0.1 percent to 36,426.08 as of 9:59 a.m. in Mumbai, swinging between a gain of as much as 0.2 percent and a drop of 0.1 percent. The NSE Nifty 50 Index was little changed at 10,925.45.

In the absence of any surprises in the earnings reports of Indian companies for the last quarter of 2018, local equities are seen reacting to the developments of global trade negotiations and domestic political campaigning ahead of the national elections that are likely to start in April.

Strategist Views

- “Slowing global growth, drying liquidity from both overseas and local investors are the major risks to stocks,” said Manish Sonthalia, chief investment officer of portfolio management services at Motilal Oswal Asset Management Co. in Mumbai.

- “A likely better economic expansion for India, companies reducing their debts and lower oil prices are the tailwinds.”

- The outcome of U.S.-China trade talks, interest-rate action by the Reserve Bank of India and political rhetoric heading into the general elections will determine short-term direction, Sonthalia said.

- “We remain long on Indian equities and prefer” shares of consumer staples, privately-owned banks that lend more to companies than retail customers, software exporters and drug makers, he said.

The Numbers

- Fourteen of the 19 sector indexes compiled by BSE Ltd. gained, paced by a gauge of metal stocks that rebounded from a drop of 2.3 percent on Tuesday.

- Nineteen of the the 31 Sensex members and 33 of the 50 Nifty companies climbed.

- Net incomes of seven of the 10 Nifty companies that have reported earnings so far have either topped or matched analyst estimates, according to data compiled by Bloomberg.

- ICICI Prudential Life Insurance Co. plunged 8.3 percent, the steepest drop on the S&P BSE 200 and S&P BSE 500 gauges, after it reported a 34 percent decline in its December quarter net income from a year earlier.

Analyst Notes/Market-Related Stories

- Nifty Pattern Shows Breakout; Avoid Over Leverage: IndiaNivesh

- Asian EM Bank Stocks May Have a ‘Volatile’ 2019, Citigroup Says

- Asian Paints Raised to Outperform at Macquarie; PT 1,580 Rupees

To contact the reporter on this story: Ameya Karve in Mumbai at akarve@bloomberg.net

To contact the editors responsible for this story: Divya Balji at dbalji1@bloomberg.net, Margo Towie, Kurt Schussler

©2019 Bloomberg L.P.