Dec 8, 2019

Indonesia Facing ‘New Norm’ of Low Inflation, Central Bank Says

, Bloomberg News

(Bloomberg) -- Indonesia has entered “a new norm” of historically low inflation, according to a senior central bank official, possibly portending an era of lower interest rates.

While Indonesia has in the past seen inflation around 6% -- even in double digits -- “right now there’s a new norm. We already have 3%,” Bank Indonesia Senior Deputy Governor Destry Damayanti said in an interview in Jakarta. “If we can maintain inflation at this level, of course this will be reflected in our interest rate.”

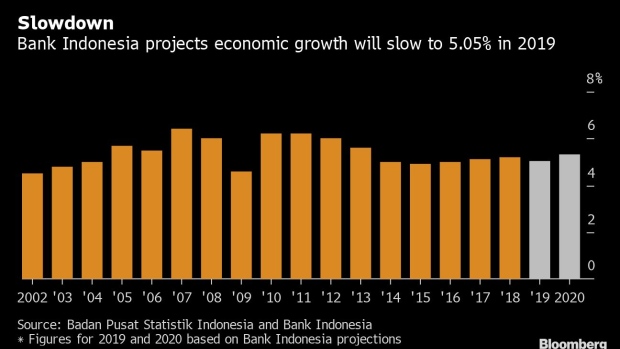

The comments come as Indonesia’s central bank adopts a more cautious approach to lowering interest rates further. While additional easing remains on the table, Damayanti said Friday a further adjustment to the key rate “is not the only weapon” the central bank can employ.As global growth slows, Indonesian officials have become increasingly worried about the state of Southeast Asia’s largest economy. The government has revised down its 2019 growth projection several times, with the economy now on course for its slowest expansion since 2017.

Damayanti flagged that rates may remain on hold as the bank waits to gauge the impact of an aggressive stretch that has seen 100 basis points of cuts since July. Despite continued weakness in the economy, Damayanti said the depth of easing may not end up matching the extent of last year’s 175 basis points of tightening.“We cannot say that. It really depends on the situation, global and also domestic,” she said. “We still have to maintain the attractiveness” of Indonesian assets, she added, pointing to the spread between local and U.S. rates.

Not Good Enough

Indonesia’s economy has lost momentum in every quarter this year. Gross domestic product is forecast to expand about 5.1% this year, down from an initial projection of 5.3%.

“Is it enough if Indonesia only grows at 5%? Of course not,” Damayanti said. “We need more acceleration in growth.”

The impact of this year’s rate cuts will start to be felt in the first quarter of 2020, she said. Damayanti said the central bank is confident the economy will pick up in 2020, with growth expected closer to the midpoint of a 5.1%-5.5% range and private consumption seen growing about 5%.

While Bank Indonesia’s main objective is stability of the rupiah, reflected in part by the inflation rate, its focus more recently has been on supporting growth and fiscal stability. At the same time, inflation has been trending down in recent years after hitting 8.4% in December 2014.

Inflation for all of 2019 is expected to come in at 3.1% after the consumer price index hit a seven-month low of 3% in November. The central bank is set to cut its inflation target band to 2%-4% in 2020, from 2.5%-4.5% this year.

Policy Mix

Bank Indonesia will keep policy accommodative to support growth, but may use other tools beside rate cuts, Damayanti said. Last month the central bank held its benchmark rate steady but lowered the proportion of funds banks must keep in reserve, a step to pump cash into the economy.

Damayanti said the bank might opt for further adjustments to reserve ratio levels and other macroprudential levers.

“We’re using a mixed policy,” she said. “The interest rate is not the only weapon we have.”

To contact the reporter on this story: Karlis Salna in Jakarta at ksalna@bloomberg.net

To contact the editors responsible for this story: Nasreen Seria at nseria@bloomberg.net, Michael S. Arnold, Thomas Kutty Abraham

©2019 Bloomberg L.P.