Nov 5, 2019

Indonesia’s Steady GDP Figures Leave Some Economists Doubting Its Data

, Bloomberg News

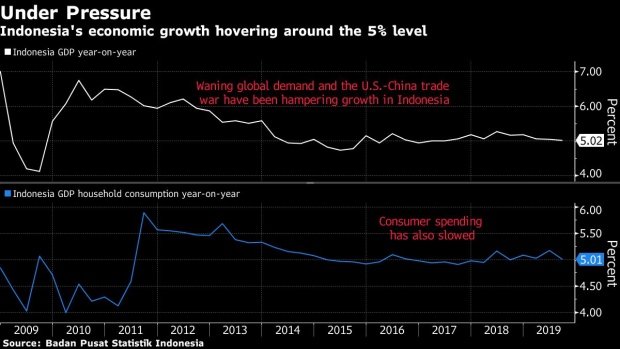

(Bloomberg) -- Indonesia’s economic growth has barely moved in three quarters, prompting some analysts to cast doubt about the data.

Gross domestic product rose 5.02% in the third quarter from a year ago, little changed from 5.05% in the second quarter and 5.07% in the first three months of the year. Growth has hovered around 5% since President Joko Widodo came into office in 2014.

“We don’t have much faith in Indonesia’s official GDP figures, which have been suspiciously stable over the past few years,” Gareth Leather, an economist at Capital Economics Ltd. in London, said in a report. Capital Economics’s own activity tracker, which is based on monthly indicators, suggest “growth has slowed sharply over the past year,” he said.

The official figures published by the statistics bureau was broadly in line with the median estimate of 5% in a Bloomberg survey of economists.

Suhariyanto, the head of statistics bureau who goes by one name, told reporters in Jakarta that trade tensions had hurt growth in advanced and emerging economies, including Indonesia. The figures show almost stagnant growth in exports, while imports plunged 8.96% from a year ago.

Trinh Nguyen, an economist at Natixis SA in Hong Kong, also questioned the figures in a post on Twitter.

Same Rate

“I don’t know how an economy can grow at the same rate for so long but Indonesia has,” she said. “Gov spending is weak & investment slowing & imports contracting HARD.”

Suhariyanto wasn’t immediately available to comment on analysts’ doubts about GDP data.

Jobless figures released Tuesday showed the unemployment rate had risen to 5.28% in August compared to 5.01% in February. Indonesia only releases unemployment data twice a year.

Growth in household spending weakened to 5.01% in the third quarter from 5.17% in the previous three months, while government spending slumped to 0.98% from 8.23%. Investment growth also slowed to 4.21% from 5.01%.

The subdued growth figures could pave the way for further monetary easing from the central bank after four interest rate cuts this year. Governor Perry Warjiyo has said further policy moves will depend on incoming economic data.

The GDP data “is another reason to think Bank Indonesia’s easing cycle is not over yet,” said Krystal Tan, an economist at Australia & New Zealand Banking Group Ltd. in Singapore.

Official growth forecasts have been pared back several times this year, with the government now projecting the economy will grow 5.1% in 2019 compared to an initial estimate of 5.3%. The International Monetary Fund has a slightly more bleak outlook, last month cutting its 2019 projection for Indonesia to 5% from 5.2% in July.

The Jakarta Composite Index rose as much as 0.9% and the rupiah gained 0.1% after the data was released.

Growth of 5% was a “relatively good sign amid the slowdown in the world economy and economies around the region,” said Enrico Tanuwidjaja, head of economics and research for PT UOB Indonesia in Jakarta. The central bank still has space to ease policy further, but will likely use “other policy levers to prop up growth further” before cutting rates again, he said.

--With assistance from Tassia Sipahutar, Harry Suhartono, Tomoko Sato and Manish Modi.

To contact the reporters on this story: Karlis Salna in Jakarta at ksalna@bloomberg.net;Rieka Rahadiana in Jakarta at rrahadiana@bloomberg.net;Viriya Singgih in Jakarta at vsinggih@bloomberg.net

To contact the editors responsible for this story: Nasreen Seria at nseria@bloomberg.net;Thomas Kutty Abraham at tabraham4@bloomberg.net

©2019 Bloomberg L.P.