Aug 14, 2019

Indonesia's Trillion Dollar Economy Is About to Get a Reboot

, Bloomberg News

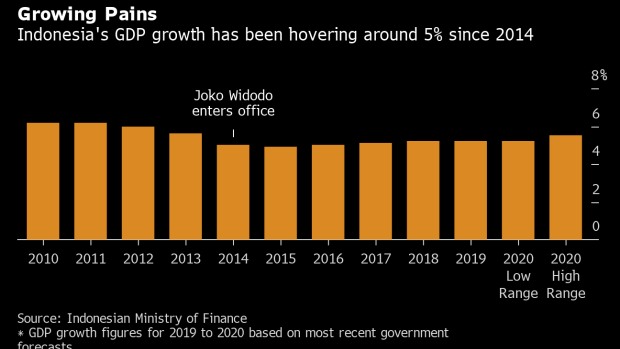

(Bloomberg) -- Indonesian President Joko Widodo is set to unveil measures to lift Southeast Asia’s largest economy from the stagnation that’s marked his first term, amid rising risks from a global slowdown and escalating trade war.

Jokowi, as Widodo is known, is set to lift government spending to a record in the 2020 budget due Friday, and is expected to set a higher target for economic growth. The president, who will begin a second five-year term in October, may also project a lower fiscal deficit target, while expanding the infrastructure drive that underpinned his first term.

With growth slowing to a two-year low last quarter, Jokowi will need to balance the need to stimulate the economy in the short term while pursuing longer-term reforms that can boost manufacturing and exports, creating jobs in a country of more than 260 million people. The president may announce steps to overhaul labor laws, address the labor force’s skills gap and shore up tax collection needed to fund welfare programs.

“They definitely have to keep in mind the external risks in drafting the budget, but I think Indonesia has plenty of fiscal space to generate growth internally,” said Euben Paracuelles, an economist at Nomura Holdings Inc. in Singapore. “If anything, this could be an opportunity to get legislative support to run a more expansionary fiscal stance in the face of greater external risks.”

The president heads into his second term with an increased majority that gives him greater authority over parliament and a mandate to push his agenda. He’s pledged to implement tough reforms to attract foreign investment and unleash the potential of Southeast Asia’s only trillion-dollar economy.

Here’s a look at what’s expected in Jokowi’s 2020 budget, to be presented to parliament Friday:

Outlook

With global demand waning and the U.S-China trade war escalating, Indonesia’s economy may struggle to clear 5% growth, where it’s hovered for several years. Gross domestic product rose 5.05% in the second quarter, its slowest pace in two years and the third quarterly decline in a row.

Jokowi is expected to settle for the mid-point of a growth range of 5.2% to 5.5% agreed by the government and parliament. That could still put Indonesia on course for the fastest expansion since 2013.

The budget deficit may be set in a range from 1.52% to 1.75% of gross domestic product, the government has said. That’s narrower than the 2019 estimate of 1.93%, and well below the legal limit of 3%.

Labor Reform

Indonesia’s labor force is larger than the combined populations of the U.K. and South Africa, but it has a productivity problem. Jokowi is promising sweeping changes, from making it easier to hire and fire workers to increasing funding for vocational training, to make Indonesia more competitive and attract foreign investment.

Steps to improve of labor-force quality could help Indonesia boost its economic potential, as the output gap -- the difference between actual and potential output -- has shrunk almost to zero. The president is expected to boost spending on education to lift workers’ skill levels, seen as a crucial step toward achieving economic growth of more than 6%.

“The government had repeatedly said its focus will be on human-resource development and social security,” said Dian Ayu Yustina, an economist at PT Bank Danamon in Jakarta. That would likely mean an increase in allocations for the relevant ministries, she said.

Infrastructure

Nation-building was the key theme of Jokowi’s first term as he rolled out new roads, ports and railways. That’s set to continue with the government drafting ambitious plans for more than $400 billion in projects, from 25 airports to new power plants.

The 2020 budget will be about “refining the spending focus toward improving quality,” said Aldian Taloputra, an economist at Standard Chartered Plc in Jakarta. Infrastructure will continue to be a “big-ticket item” as the government proceeds with a raft of projects already on the books, he said.

Tax Cuts

A plan to lower corporate tax also aims to boost Indonesia’s competitiveness. Jokowi wants to attract more foreign investment and revive the country’s manufacturing sector, which accounted for less than 20% of GDP in the second quarter compared to 26% a decade ago.

Jokowi said in July he would seek parliamentary support to reduce corporate taxes to 20% or lower. That can help Indonesia compete with regional rivals like Vietnam and Thailand in luring companies seeking to relocate business away from China amid the trade war.

With the government having already announced a slew of tax incentives for certain sectors, plans for additional tax benefits for companies makes it clear “stimulus for growth will be key,” Bank Danamon’s Yustina said.

To contact the reporters on this story: Karlis Salna in Jakarta at ksalna@bloomberg.net;Viriya Singgih in Jakarta at vsinggih@bloomberg.net

To contact the editors responsible for this story: Nasreen Seria at nseria@bloomberg.net, Thomas Kutty Abraham, Michael S. Arnold

©2019 Bloomberg L.P.