May 10, 2022

Industrial Gas Demand in Chinese Factory Hub Fell 43% Last Month

, Bloomberg News

(Bloomberg) -- Industrial demand for natural gas in the factory-heavy province of Jiangsu slumped 43% in April from a year earlier, in another sign of how virus lockdowns are wreaking havoc on China’s economy.

Jiangsu is China’s second-biggest provincial economy and it lies just to the north of Shanghai, where the harshest Covid-19 restrictions resulted in a web of quarantine rules disrupting transport and labor. The figures are from the National Energy Administration.

See also: A Third of China’s Economy Lagged the Nation in First Quarter

Across the entire country, gas demand fell by around 6% last month from a year earlier to the lowest since September 2021, while industrial consumption was down 8.4%, Morgan Stanley said in a note that cited data from BSC Energy Consulting. The figures compared with a 2.1% year-on-year decline in overall demand in March.

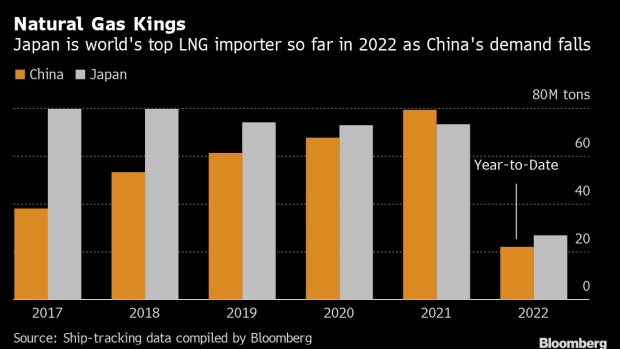

China -- the world’s biggest liquefied natural gas importer last year -- has stuck to its Covid Zero approach to quell outbreaks, weighing on energy consumption. Prices of the super-chilled fuel -- used for industry, heating and electricity generation -- are also at elevated levels due to rising demand and less supplies from Russia following its invasion of Ukraine.

“The weak industrial demand in March and April was caused by a combination of high gas cost and Covid-containment measures,” Morgan Stanley analysts including Simon Lee said in the note dated May 9.

See also: China’s Oil Demand Is Tumbling the Most Since Wuhan Lockdown

China’s biggest gas importers have curbed purchases in the past year due to high spot prices, mild winter weather and lackluster demand. The country’s LNG imports are down nearly 20% in the first four months of the year from the same period in 2021, ship-tracking data compiled by Bloomberg show.

©2022 Bloomberg L.P.