Dec 9, 2021

Inflation Near 40-Year High Shocks Americans, Spooks Washington

, Bloomberg News

(Bloomberg) -- The U.S. is poised to enter Year Three of the pandemic with both a booming economy and a still-mutating virus. But for Washington and Wall Street, one Covid aftershock is starting to eclipse almost everything else.

Already-hot inflation is forecast to climb even further when November data comes out on Friday, to 6.8%. That would be the highest rate since Ronald Reagan was president in the early 1980s -- and in the lifetimes of most Americans.

Higher prices helped deliver a banner year for U.S. business, which is posting its fattest profit margins since the 1950s. But for Joe Biden’s administration and the Federal Reserve -– who didn’t see it coming -- the sudden return of inflation, largely dormant for decades before 2021, is looking increasingly traumatic.

It’s likely to drive some big changes in the coming year, as the Fed pivots toward raising interest rates and the president heads into midterm elections with slumping approval ratings.

How did it happen? Essentially, the pandemic made it harder for the world to produce stuff and move it around. The government shored up incomes in the crisis like never before, so households remained eager to spend. And a combination of lockdowns and Covid caution meant their purchasing power was focused on consumer goods instead of services.

That’s why there are long lines of cargo ships stretching off the coast of Los Angeles waiting to dock, while used-car dealers keep hiking prices and a global commodities rally leaves Americans paying more at grocery stores and gas pumps.

Hotspots to Everywhere

A year ago, economists were forecasting 2% inflation for 2021. The pandemic had depressed prices early on, and everyone expected a rebound. But Fed Chair Jerome Powell’s prediction that it would be temporary, and not very large, was widely shared.

The first hint that inflation was about to really accelerate came in February, said Omair Sharif, president of research company Inflation Insights LLC. “Something was bubbling under the surface -- and more specifically in autos.”

A pandemic-driven shortage of semiconductors was holding back production of new cars, so buyers -- including rental firms, who’d sold off their fleets earlier in the crisis -- were bidding up the prices of old ones.

Americans had the cash. In contrast to the last recession, when fiscal austerity held back the recovery, Congress kept the stimulus flowing. On top of the $2.2 trillion rescue package in the spring of 2020, when the pandemic arrived, came another $900 billion in December 2020, then $1.9 trillion more in March after Biden took office.

But consumers remained reluctant to spend money in gyms or restaurants, say, where they might catch Covid-19 -– so they bought more goods instead. Shortages of materials, and workers, were creating bottlenecks all along the supply chain. Ports got jammed. Imports kept breaking records.

“It was a demand shock,” says Aneta Markowska, chief financial economist at Jefferies. “It’s the U.S. consumer essentially that caused this inflationary impulse, by just buying more stuff than the global economy can produce.”

Commodity Stories

With other countries recovering too, albeit less exuberantly, globalized commodities like oil were rebounding. U.S. pump prices are about 50% higher than a year ago.

The commodity surge wasn’t limited to energy. One of the pandemic inflation’s headline-grabbing episodes came in lumber markets, where prices jumped about 70% from early March to early May –- adding steam to an incipient housing boom.

When the lumber bubble burst, some -- including Powell -- cited it as an example of how pandemic inflation could soon fade. But global food prices, after a lull in June and July, started climbing again. Helped by some bad weather around the planet, they were up 27% in the 12 months through November, reflecting jumps in everything from meat and wheat to coffee and cooking oil.

Grocery chain Kroger Co. “saw higher product cost inflation in most categories” in the third quarter, Chief Financial Officer Gary Millerchip said on a Dec. 2 earnings call. “We are passing along higher cost to the customer where it makes sense to do so.”

For American business, those higher costs included wage bills. Employers were struggling to increase headcount fast enough to meet soaring demand. In June, Chipotle Mexican Grill Inc. made headlines by hiking prices some 4% to offset pay raises. Plenty more companies would join them as the year went on.

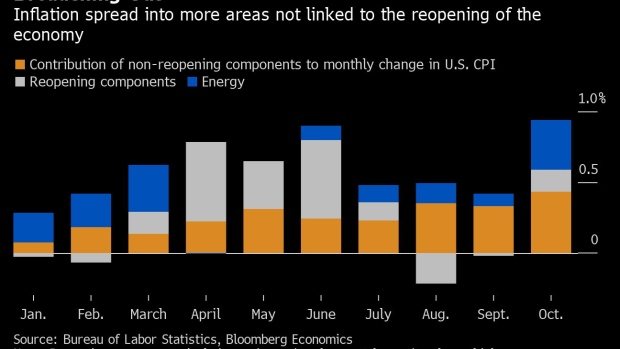

At least in the eyes of the market, September’s CPI report was the turning point, when inflation spread well beyond a handful of hotspots. The overall rise in the index was muted -– but food and shelter contributed more than half of it, with rents jumping the most in two decades.

Biden Feels Heat

Biden’s plan had been to follow up Covid stimulus with multi-trillion-dollar investments in child-care and clean energy. Centrist Democrats in Congress, though, were already pointing to government spending as a driver of rising inflation -- and balking at voting for more of it. The programs were scaled back. More cuts may follow in the Senate this month.

The president’s approval ratings were on the slide, with polls suggesting voters don’t like his handling of the economy and are inclined to blame him for inflation. That spells trouble for his party, which must defend thin majorities in mid-term elections next November.

Biden set up a supply-chain task force to ease logjams, released petroleum reserves, and called out gasoline companies for pocketing too much profit. He’s under pressure to do more -- but presidents have limited powers to counter price increases.

Powell Caves

Throughout 2021 the White House, when pressed on inflation, has deferred to the Fed -- citing experts there who said it would be transitory. But in recent months, as prices surged, Fed officials faced growing resistance to that stance, and began backing away from it.

On Nov. 30, just over a week after he was tapped by Biden to serve a second term, Powell finally caved. “I think the word ‘transitory’ has different meanings to different people,” he said. “It’s probably a good time to retire that word.”

A few minutes later, he made big news: Fed officials, at their next policy meeting on Dec. 14-15, would consider accelerating the withdrawal of monetary stimulus -- potentially ending their bond purchases as early as March, and opening the door to interest-rate increases by the middle of next year.

Powell’s pivot came as a surprise, with market volatility surging after the arrival of the Omicron variant. Fed officials tend to downplay the idea that any one month’s worth of data -- which is all they had since taper plans were laid out in early November -- is enough to force a change in monetary policy.

Kitchen Tables

By that point, the great inflation debate had broken out of policy circles. It was now conducted around kitchen tables, too.

Economists tend to look at so-called “core inflation,” which strips out more volatile food and energy prices. For American workers, paying a dollar more per gallon at the gas pump, or 20% more for beef, is a more tangible measure.

In November, one in four respondents to a University of Michigan survey said inflation had lowered their living standards, double the level of six months earlier. The unaccustomed jump in living costs put the spotlight on incomes, and whether they’re keeping up.

With bosses desperate to fill an unprecedented number of vacant jobs, workers are enjoying rare bargaining power. Some 10,000 workers at Deere & Co. went on strike for the first time since 1986, winning a 10% raise plus better retirement benefits.

Across the economy, compensation rose at the fastest pace on record in the third quarter. Those at the bottom of the pay scale have benefited most -- although even there, wage hikes mostly are below the current rate of inflation.

What’s Next?

While Bloomberg Economics predicts inflation close to 7% for another few months, there’s widespread agreement that it will come down at some point next year.

Energy markets are already signaling some relief, with oil down about 15% since late October, presaging lower fuel and transportation costs in 2022. Durable goods inflation is projected to slow as the pandemic recedes and households return to more-normal spending patterns.

One offset to that may be housing costs. Bloomberg Economics’ David Wilcox says they could be rising at a 6% to 7% pace by next summer, about double the rate in the years before the pandemic.

Maybe the biggest unknown in 2022 is wages, already rising faster than at any point in the decade-long expansion that ended with the arrival of Covid-19.

“The question for me isn’t whether inflation will slow,” said Markowska at Jefferies. “The question is, are we going back to 2? Are we going back to 3? What’s the medium-term destination? And that’s, I think, going to be determined by the labor market.”

©2021 Bloomberg L.P.