Jun 3, 2022

Canadians' inflation worries deepen in blow to central bank

, Bloomberg News

Hiking over 50bps depends on data: BoC Deputy Governor

Canadians see consumer price pressures worsening over the next year and are unconvinced policy makers are committed to bringing inflation back to pre-pandemic levels, according to a new poll.

Asked what they think annual inflation will be in 12 months, a majority of respondents said it would be above the current level of about 7 per cent, according to a survey by Nanos Research Group for Bloomberg News. The median estimate was 8 per cent.

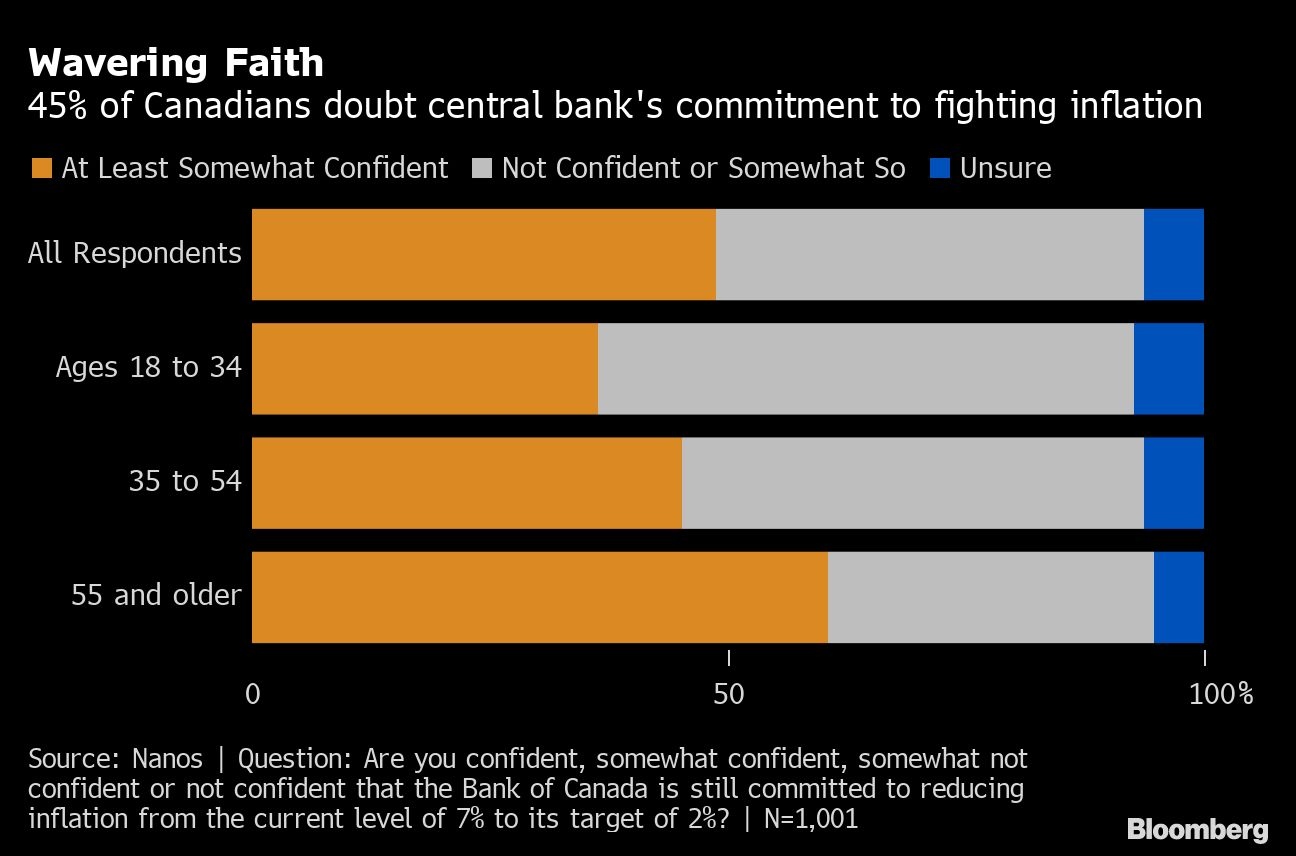

About 45 per cent in the survey expressed doubts about the Bank of Canada’s commitment to achieving its 2 per cent inflation target.

The results suggest opinion may be hardening around the idea inflation will remain elevated. It’s a worrying development for the central bank, as it could force policy makers into even more aggressive interest-rate hikes to keep expectations more anchored.

Canada’s inflation rate hit 6.8 per cent in April and is poised to come in higher for May. The data are due three weeks before Governor Tiff Macklem announces the next policy decision on July 13, with markets and economists expecting a third consecutive half-point hike.

Expected inflation is a major determinant of actual inflation since businesses increase prices and workers seek pay raises in part on what they anticipate prices will look like in future. That’s why central bank officials have become very concerned about the self-fulfilling dynamics of persistently high inflation, which was the theme of a speech Thursday by Deputy Governor Paul Beaudry.

The central bank has already raised its benchmark overnight lending rate to 1.5 per cent from 0.25 per cent in early March. That’s expected to jump to 3 per cent by the end of this year, and to 3.25 per cent next year. Rates commercial banks give to their prime customers are typically just over 2 percentage points above the Bank of Canada benchmark.

The hawkish pivot is in large part a confidence-building exercise to convince Canadians that policy makers remain focused on cooling price pressures and bringing inflation back down to the central bank’s target.

In his speech, Beaudry said risks of de-anchored expectations have become a major worry.

“High inflation for extended periods can also complicate the bank’s ability to bring inflation back to our 2 per cent target,” Beaudry said. “That’s because inflation can become self-fulfilling if it leads households and businesses to expect higher inflation in the future.”

The Nanos poll is a hybrid telephone and online survey of 1,001 Canadians, with a margin of error of 3.1 percentage points, taken between May 26th and 30th. It found that almost one-third of respondents see inflation at 10 per cent or higher, while only 2 per cent of Canadians expect it will be at 2 per cent or below in a year’s time.

The poll also found 21 per cent of Canadians aren’t confident that the central bank is still committed to its target, while 24 per cent said they were somewhat not confident.

Bloomberg has never polled before on these questions, so there is no time series for comparison. There is evidence Canadians often tend to perceive inflation as higher than the actual measured rate.

While the Bank of Canada’s own surveys have found inflation expectations have increased over the short term, officials argue longer-term expectations remain anchored.