Nov 16, 2022

Inflationary Pressures in Canada Hit Their Broadest Since 1991

, Bloomberg News

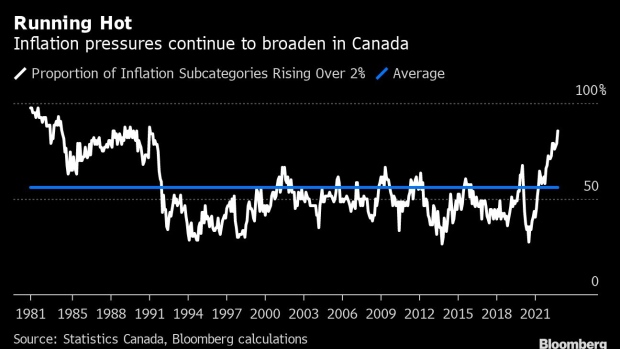

(Bloomberg) -- Inflation in Canada has started to stabilize but price pressures are getting broader, which may be a red flag for the central bank.

Annual price gains stalled at 6.9% in October, better than many economists were expecting and down from a peak of 8.1% in June, according to Statistics Canada.

But over 85% of 62 subcategories tracked in the consumer price index are still rising by more than the Bank of Canada’s 2% inflation target. That’s the highest proportion since 1991, well above the historical average of 56% and up from 79% in September.

In March, when Governor Tiff Macklem began an aggressive series of interest-rate increases, 71% of subcategories were above target. Nearly three-fifths of prices are now rising by more than 5% on an annual basis.

“While headline inflation came in below expectations, the details of the report reinforced that underlying price pressures remain intense,” Benjamin Reitzes, a rates and macro strategist with Bank of Montreal, said by email. “The Bank of Canada has cited the breadth of inflation as a key point of concern, and there was no let up on that front.”

Food price gains slowed in October but still topped 10%, and there remains a lot of price pressure at grocery stores.

Eric La Fleche, chief executive officer of supermarket chain Metro Inc., said Wednesday that suppliers are expecting to pass on higher costs to customers in the new year. “The inflation outlook remains uncertain as we continue to receive many vendor requests for price increases,” he said on a conference call.

The spreading pressures could justify further tightening from the Bank of Canada, which has already increased the benchmark overnight lending rate by 350 basis points to 3.75%.

Markets are betting on at least another 25 basis-point increase at the next policy decision on Dec. 7, with a 50-50 chance of a half percentage point hike. Traders see interest rates rising to at least 4.25% early next year.

--With assistance from Mathieu Dion.

©2022 Bloomberg L.P.