Mar 13, 2023

Interest Payments Soar in Canada by Most Since at Least 1990

, Bloomberg News

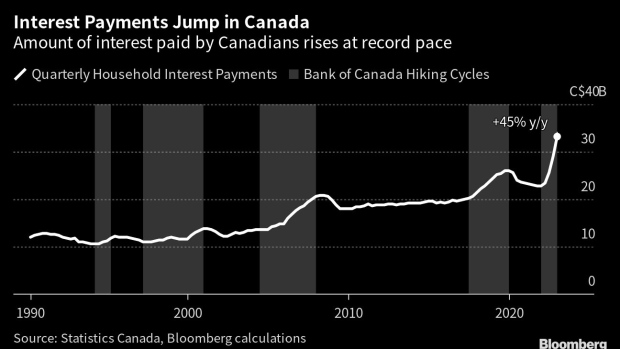

(Bloomberg) -- The amount of interest paid by Canadian households rose at the fastest pace in more than three decades as the central bank ratcheted up borrowing costs.

Interest payments totaled C$33.2 billion ($24.1 billion) in the fourth quarter of last year, up 45% from a year earlier, according to data released Monday by Statistics Canada. That’s the fastest increase in records back to 1990, and includes a 14.1% gain in the last three months of 2022.

The record expenditures on interest add to evidence that highly indebted households are becoming increasingly burdened by the Bank of Canada’s aggressive rate hikes, pointing to an imminent slowing of consumption.

Policymakers led by Governor Tiff Macklem have paused their tightening campaign, holding the benchmark overnight rate at 4.5% last week. Traders in swaps markets have swiftly shifted their bets for the Bank of Canada’s next move to be a cut amid global concern about the collapse of three US lenders, including Silicon Valley Bank.

The amount of household payments to obligated mortgage principal, meanwhile, fell 7% over the last year, partly due to a higher proportion of adjustable rate loans picked up by Canadians over the pandemic, the agency said.

“The significant stock of variable rate mortgages likely allowed interest payments to further adjust without a concomitant rise in principal,” Statistics Canada said in the release.

Canadian incomes outpaced increases in debt however, with the debt-to-income ratio edging down to 180.5% in the fourth quarter from 184.3% previously. The household debt service ratio rose to 14.33%.

©2023 Bloomberg L.P.