Aug 24, 2022

Invesco Sees ‘Rude Awakening’ With Oil, Food Set to Spike Soon

, Bloomberg News

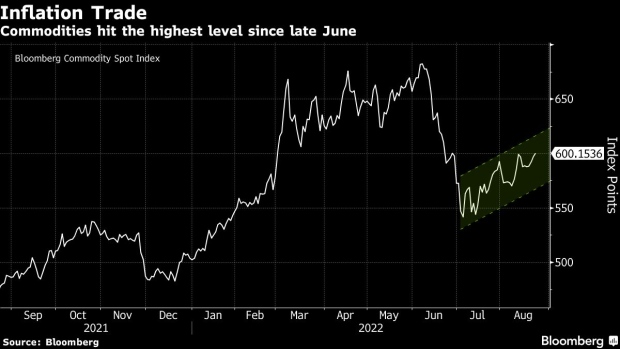

(Bloomberg) -- One commodities strategist has a message for those hoping declining food and energy prices mean inflation woes are waning: not so fast.

To Invesco’s Jason Bloom, autumn will be a “rude awakening” to the market as a number of headwinds push commodities prices higher, including Washington’s end of the US Strategic Petroleum Reserve releases in October, which will constrain oil supply just as the winter season ushers in more demand for energy.

The firm’s head of fixed income and alternatives product strategy is also bracing for the ripple effects that high natural gas prices in Europe will have on other volatile markets such as smelter shut downs and shortages of industrial metals. Meanwhile, the war in Ukraine may make that nation’s autumn harvest less plentiful, which will push food prices higher as Russian exports shrink and droughts threaten crops in the US.

“That’s what everybody else is saying, crude oil prices have stopped going up, and so therefore we’re just going to bake in a flat price for commodities over the next year,” Bloom said. “On what basis are you assuming commodity prices are going to be flat just because they came down from their peak after the war?”

Bloom said the market’s hope that the retreating inflation foreshadows a return to the price stability of the recent past is misguided. Although the headline CPI reading may not hit new highs, he says continued pressure on commodity prices will prevent stubbornly high inflation from abating as quickly as bond market proxies suggest.

This isn’t Bloom’s first time making a market call on inflation. In 2019, after nearly a decade of flat commodity prices, he was part of a small band of strategists predicting inflation would emerge in 2020 as global growth rebounded and central banks took a back seat to snuffing it out after being blamed for too-hasty rate increases in 2018.

Three years later, Bloom sees a new economic backdrop unfolding, characterized by higher prices, constrained supply of metals and energy, sustained growth, a higher Federal funds rate, and inflation that is higher than where bond markets and economic models currently expect.

“We are now an environment of scarcity,” Bloom said. “We’re running out of everything. We’ve constrained supply. So against that backdrop, why would you model the previous decade and apply it now? That was not a decade of scarcity.”

To be sure, the post-pandemic market has meant nearly every economic model has been inaccurate in predicting just how stubborn inflation would be.

Some of the world’s biggest bond investors at firms including Pacific Investment Management Co., Capital Group and Union Investment also say that inflation will hold well above the 2% level targeted by major central banks.

Their views contrast with speculation that pricing pressures will ease so much that the Federal Reserve may begin cutting interest rates as soon as next year to jump-start economic growth. Bloom said the yield on the US 10-year Treasury bond could go as high as 4% by the end of the year, causing a headache for bond investors that have already suffered record losses this year.

Read more: ‘Tsunami of Shutoffs’ Looms With 1 in 6 Late on US Energy Bills

However, Ed Morse, global head of commodities research at Citi, predicts a slowdown in US and China transportation demand will bring down inflation.

“On the oil side supply and demand was tight and it’s now reversing and leading to the inventory build. The inventory data indicates a much looser market,” Morse said.

There is something else to be optimistic about, according to Bloom. In this high inflation, high growth era where old economic models don’t work, one of those could be the yield curve, which is currently inverted, signaling to many that a recession is on the way.

“Growth looks to be holding up better than everyone expected. And partially it’s because we keep getting all this fiscal stimulus,” he said, noting last year’s infrastructure bill and Biden’s new clean energy bill. “That’s a lot of capital investment to cushion sustained growth in the economy, to the extent that the Fed is trying to tamp down the consumer.”

©2022 Bloomberg L.P.